Sustainable Energy

Gujarat, Kerala Top India’s Rooftop Solar Race as PMSGY Expands, Yet Financial Bottlenecks Linger

India’s rooftop solar mission is gaining pace under PMSGY, led by Gujarat and Kerala. Yet, limited financing access and supply chain gaps continue to test its momentum

India’s flagship Pradhan Mantri Surya Ghar Yojana (PMSGY) has given a major push to the country’s residential rooftop solar (RTS) sector, adding nearly 4.9 gigawatts (GW) of new capacity in just over a year since its launch. Yet, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics, challenges in financing, supply chains, and consumer awareness continue to slow progress toward national targets.

The report, Advancing Residential Rooftop Solar Adoption in India under PM Surya Ghar Yojana, notes that as of July 2025, over 57.9 lakh households have applied for rooftop solar systems under the scheme. Despite this surge — a fourfold rise in applications since March 2024 — only 22.7% have translated into actual installations.

“PMSGY has steadily expanded its policy framework to speed up residential rooftop solar adoption. Since 2024, it has rolled out a nationwide capacity-building programme to train over three lakh people and help vendors, utilities and financiers upskill,” says, Jyoti Gulia, Founder, JMK Research.

Gujarat, Kerala Lead the Way

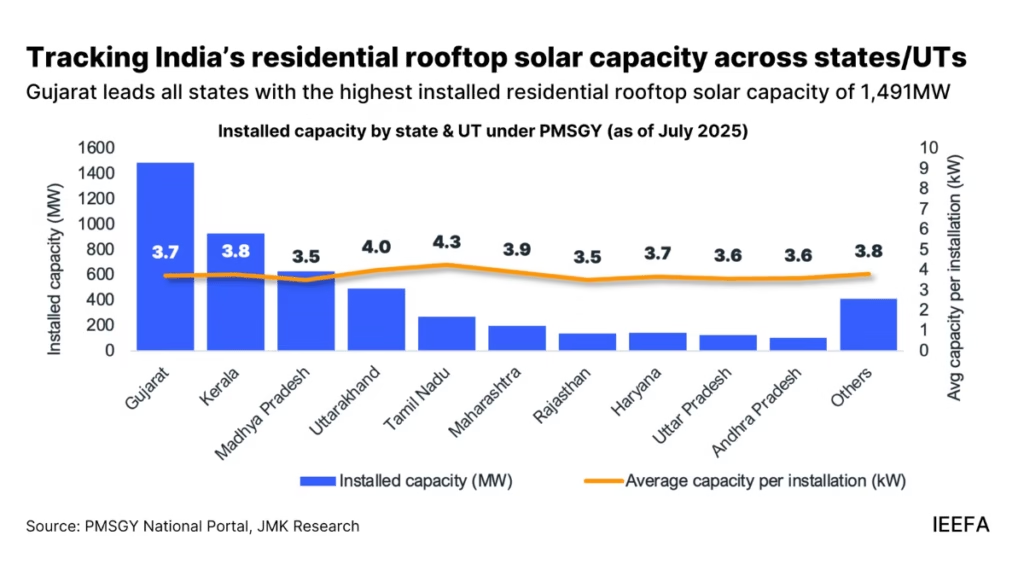

Gujarat has emerged as the clear front-runner, boasting 1,491 MW of installed residential rooftop capacity — the highest in the country. Maharashtra, Uttar Pradesh, Kerala, and Rajasthan follow, together accounting for more than 77% of total installations under the programme.

These states’ success is credited to their mature solar ecosystems, strong vendor bases, and high consumer awareness. Gujarat and Kerala, for instance, have achieved conversion ratios of over 65%, far above the national average.

However, Kerala’s success has been uneven. As highlighted in an EdPublica investigation — Why Kerala Has Struggled to Replicate Perinjanam’s Solar Success — the state’s progress has been shaped by strong community-led models like Perinjanam’s solar initiative, but replication across districts has faced institutional and financial hurdles. Local leadership and decentralised governance, experts argue, remain key to scaling up such success stories statewide.

Financing, Awareness, and Supply Chain Barriers

Despite the scheme’s momentum, several bottlenecks remain. The report highlights that low consumer awareness of financing options, complicated loan procedures, and technical glitches in the grievance redressal system hinder wider adoption.

“However, low consumer awareness and access to finance remain significant barriers to the adoption of rooftop solar. Outdated perceptions of high upfront costs and maintenance persist, especially in rural areas,” says Prabhakar Sharma, Senior Consultant, JMK Research.

Fragmented supply chains for critical components such as solar panels, inverters, and mounting structures have also caused project delays.

“Establishing clear, time-bound rooftop solar capacity targets at the state level is essential for creating a coherent vision and ensuring effective policy execution,” Vibhuti Garg, Director, IEEFA – South Asia, points out.

Need for Stronger Local Implementation

The report notes that although a grievance redressal mechanism has been set up under PMSGY, its effectiveness remains limited. “PMSGY should establish a district-level escalation matrix so that subsidy disbursement delays, incorrect data entries or portal malfunctions can be routed beyond the DISCOM or portal level,” Aman Gupta, Research Associate, JMK Research says.

Analysts recommend creating state and district facilitation cells to guide consumers through the application and subsidy process, along with extensive public awareness campaigns to educate households about long-term savings from rooftop solar.

Standardisation and Plug-and-Play Solutions

The report stresses the need for standardised rooftop solar kits that integrate panels, inverters, and cables into ready-to-install packages.

“The rooftop solar market continues to face fragmented quality and weak end-to-end guarantees, challenges that standardised plug-and-play solutions can resolve,” Prabhakar Sharma adds.

Promoting the commoditisation of rooftop systems, the authors argue, can help speed up installations and minimise delays.

Beyond Subsidies: Building a Solar-Ready Ecosystem

While the central government has disbursed over INR 9,280 crore (US$1.05 billion) in subsidies so far — just 14% of the total allocated under PMSGY — experts caution that subsidies alone won’t ensure success.

“The long-term success of PMSGY hinges not only on the provision of subsidies but also on its ability to institutionalise streamlined digital processes, standardised product solutions, and consumer-centric support systems,” according to the Report authors’ conclusion.

To meet the ambitious 30GW rooftop solar target by FY2027, India will need to bridge the financing gap, build local capacity, and simplify consumer experiences — transforming rooftops across urban and rural India into decentralised clean energy generators.

Sustainable Energy

India’s EV Investment Story: Rs 2.23 Lakh Crore Deployed, But 82% of Capital Needs Still Unmet

India’s charger-to-EV ratio continues to lag far behind global benchmarks—a structural weakness that could slow consumer adoption.

India’s electric mobility transition has entered a decisive yet challenging phase. A new analysis from the Institute for Energy Economics and Financial Analysis (IEEFA) reveals a complex narrative: while the country’s EV sector has attracted an impressive Rs 2.23 lakh crore in investments between 2020 and 2025, this represents just 18% of what India must mobilise by 2030 to meet its ambitious clean transport goals.

Unfolding against the backdrop of India’s expanding climate commitments and rising consumer interest in EVs, the report offers a data-rich look into where capital is flowing, where it is missing, and what structural challenges remain hidden beneath headline growth.

A Five-Year Surge in Capital—But Not Enough

Between 2020 and 2025, the EV ecosystem—spanning manufacturing facilities, public subsidies, and charging networks—absorbed Rs 2,23,119 crore in funding. This includes:

- Manufacturing investments supported primarily through internal accruals

- Government subsidies, especially through FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles)

- Charging infrastructure, which remains under-capitalised

Despite this influx, India’s 2030 targets—30% of private cars, 70% of commercial vehicles, 40% of buses, and 80% of two- and three-wheelers going electric—require a total of Rs12.5 lakh crore in investments. That leaves Rs 10.26 lakh crore still unmet.

“While Rs 2.23 lakh crore is a significant capital mobilisation in just five years, it represents only about 18% of the Rs12,50,000 crore required by 2030,” says co-author Subham Shrivastava. “Mobilising the remaining INR10,26,881 crore (USD117.82 billion) by 2030 will require systemic financing reforms.”

The Anatomy of EV Capital

A closer look at the numbers reveals how India’s EV push has been financed so far.

Internal reserves dominate

Manufacturers contributed the bulk of realised investment through their own internal accruals—Rs1,59,701 crore. Debt followed at Rs36,738 crore, while equity accounted for Rs 6,455 crore. But these aggregates obscure important differences across vehicle types.

The three-wheeler segment, driven by a fragmented OEM landscape and low capital-intensity operations, leaned heavily on internal funding and limited debt. Meanwhile, two- and four-wheeler categories showed more diverse capital structures due to the presence of established players and higher investment requirements.

“From 2020–2025, electric three-wheelers attracted the largest share (~78%) of investments among vehicle segments, due to the segment’s maturity and commercial-scale operations alongside its fragmented OEM base,” explains co-author Saurabh Trivedi. “However, recent investment announcements in 2024 and 2025 reveal a pivot towards electric four-wheelers, driven by rising demand for electric cars.”

Charging Infrastructure: A Massive Funding Gap

Perhaps the most critical bottleneck in India’s EV story is the underdeveloped charging ecosystem.

From 2020 to 2025, investments in public charging constituted just 9.6% of the ₹20,600 crore estimated need for 2030. While the country expanded its public chargers from 5,151 to 39,485 over five years, utilisation rates remain low and profitability uncertain.

“Investment in EV charging faces challenges due to limited investor interest, as public EV charging remains an unproven business model, with many charging stations reporting low utilisation rates and high initial costs,” notes co-author Charith Konda.

India’s charger-to-EV ratio continues to lag far behind global benchmarks—a structural weakness that could slow consumer adoption.

The Silent Brake on India’s EV Growth

Beyond infrastructure, the economics of financing EVs present another hurdle.

Commercial EV borrowers currently face interest rates of 15–33%, levels that wipe out the total cost-of-ownership advantage EVs typically offer.

“The binding constraint is not a lack of capital in the system—it is how EV risk is priced,” Shrivastava says. “When lenders remain uncertain about battery performance, residual values, and cash-flow stability, that uncertainty gets reflected in higher interest rates.”

High financing costs disincentivise fleet operators and businesses from transitioning to EVs. As a result, manufacturing capacity cannot scale at the pace needed, creating a demand-supply mismatch.

A New Model for Mobilising Capital

To unlock the remaining ₹10.3 lakh crore needed over the next five years, IEEFA proposes a shift away from subsidy-led growth toward structural risk-sharing.

The solution: a coordinated integrated EV financing platform that consolidates:

- Partial credit guarantees

- Residual value protection for batteries

- Battery-as-a-service (BaaS) arrangements

- Co-lending structures

This platform would be anchored by development finance institutions with relevant expertise—SIDBI for MSMEs and small commercial fleets, and IIFCL for large commercial deployments.

“Manufacturers need predictable demand signals to scale capacity, but demand depends heavily on affordable credit,” Trivedi adds. “An integrated platform that shares risks appropriately across lenders, OEMs, and public institutions can reduce financing costs and unlock commercial-scale deployment.”

The idea is that as EV adoption grows and asset performance data becomes more robust, lenders will recalibrate risk premiums downward. Over time, underwriting practices could standardise, securitisation markets may emerge, and capital could recycle more efficiently.

A Self-Reinforcing Investment Loop

The report outlines a possible virtuous cycle:

- Lower financing costs stimulate EV adoption

- Higher sales volumes create better performance data

- Improved visibility reduces risk perception

- Lower risk draws in more capital

- Manufacturers scale up, benefiting from economies of scale

- Reduced costs further accelerate adoption

This dynamic, according to IEEFA, is essential for unlocking a mature and self-sustaining EV ecosystem.

A Race Between Ambition and Capital

India’s electric transport ambitions are clear and achievable—but only if the investment framework evolves as rapidly as consumer interest and technological capability.

The core message from the data is unmistakable: India is moving in the right direction, but far too slowly. Recognising this, the authors warn that the next five years will determine the trajectory of India’s EV revolution. The country must transition from policy-driven electrification to a financially self-sustaining ecosystem capable of attracting large volumes of private capital at scale.

The question is no longer about policy commitment but about the cost, structure, and flow of capital in an evolving, high-potential sector.

Sustainable Energy

Can ammonia power a low-carbon future? New MIT study maps global costs and emissions

Under what conditions can ammonia truly become a low-carbon energy solution? MIT researchers attempt to resolve this

Ammonia, long known as the backbone of global fertiliser production, is increasingly being examined as a potential pillar of the clean energy transition. Energy-dense, carbon-free at the point of use, and already traded globally at scale, ammonia is emerging as a candidate fuel and a carrier of hydrogen. But its climate promise comes with a contradiction: today’s dominant method of producing ammonia carries a heavy carbon footprint.

A new study by researchers from the MIT Energy Initiative (MITEI) attempts to resolve this tension by answering a foundational question for policymakers and industry alike: under what conditions can ammonia truly become a low-carbon energy solution?

A global view of ammonia’s future

In a paper published in Energy and Environmental Science, the researchers present the largest harmonised dataset to date on the economic and environmental impacts of global ammonia supply chains. The analysis spans 63 countries and evaluates multiple production pathways, trade routes, and energy inputs, offering a comprehensive view of how ammonia could be produced, shipped, and used in a decarbonising world.

“This is the most comprehensive work on the global ammonia landscape,” says senior author Guiyan Zang, a research scientist at MITEI. “We developed many of these frameworks at MIT to be able to make better cost-benefit analyses. Hydrogen and ammonia are the only two types of fuel with no carbon at scale. If we want to use fuel to generate power and heat, but not release carbon, hydrogen and ammonia are the only options, and ammonia is easier to transport and lower-cost.”

Why data matters

Until now, assessments of ammonia’s climate potential have been fragmented. Individual studies often focused on single regions, isolated technologies, or only cost or emissions, making global comparisons difficult.

“Before this, there were no harmonized datasets quantifying the impacts of this transition,” says lead author Woojae Shin, a postdoctoral researcher at MITEI. “Everyone is talking about ammonia as a super important hydrogen carrier in the future, and also ammonia can be directly used in power generation or fertilizer and other industrial uses. But we needed this dataset. It’s filling a major knowledge gap.”

To build the database, the team synthesised results from dozens of prior studies and applied common frameworks to calculate full lifecycle emissions and costs. These calculations included feedstock extraction, production, storage, shipping, and import processing, alongside country-specific factors such as electricity prices, natural gas costs, financing conditions, and energy mix.

Comparing production pathways

Today, most ammonia is produced using the Haber–Bosch process powered by fossil fuels, commonly referred to as “grey ammonia.” In 2020, this process accounted for about 1.8 percent of global greenhouse gas emissions. While economically attractive, it is also the most carbon-intensive option.

The study finds that conventional grey ammonia produced via steam methane reforming (SMR) remains the cheapest option in the U.S. context, at around 48 cents per kilogram. However, it also carries the highest emissions, at 2.46 kilograms of CO₂ equivalent per kilogram of ammonia.

Cleaner alternatives offer substantial emissions reductions at higher cost. Pairing SMR with carbon capture and storage cuts emissions by about 61 percent, with a 29 percent cost increase. A full global shift to ammonia produced with conventional methods plus carbon capture could reduce global greenhouse gas emissions by nearly 71 percent, while raising costs by 23.2 percent.

More advanced “blue ammonia” pathways, such as auto-thermal reforming (ATR) with carbon capture, deliver deeper emissions cuts at relatively modest cost increases. One ATR configuration achieved emissions of 0.75 kilograms of CO₂ equivalent per kilogram of ammonia, at roughly 10 percent higher cost than conventional SMR.

At the far end of the spectrum, “green ammonia” produced using renewable electricity can reduce emissions by as much as 99.7 percent, but at a significantly higher cost—around 46 percent more than today’s baseline. Ammonia produced using nuclear electricity showed near-zero emissions in the analysis.

Geography matters

The study also reveals that the viability of low-carbon ammonia depends heavily on geography. Countries with abundant, low-cost natural gas are better positioned to produce blue ammonia competitively, while regions with cheap renewable electricity are more favourable for green ammonia.

China emerged as a potential future supplier of green ammonia to multiple regions, while parts of the Middle East showed strong competitiveness in low-carbon ammonia production. In contrast, ammonia produced using carbon-intensive grid electricity was often both more expensive and more polluting than conventional methods.

From research to policy

Interest in low-carbon ammonia is no longer theoretical. Countries such as Japan and South Korea have incorporated ammonia into national energy strategies, including pilot projects using ammonia for power generation and financial incentives tied to verified emissions reductions.

“Ammonia researchers, producers, as well as government officials require this data to understand the impact of different technologies and global supply corridors,” Shin says.

Zang adds that the dataset is designed not just as an academic exercise, but as a decision-making tool. “We collaborate with companies, and they need to know the full costs and lifecycle emissions associated with different options. Governments can also use this to compare options and set future policies. Any country producing ammonia needs to know which countries they can deliver to economically.”

As global demand for low-carbon fuels accelerates toward mid-century, the study suggests that ammonia’s role will depend less on ambition alone, and more on informed choices—grounded in data—about how and where it is produced.

Sustainable Energy

Do Renewables Really Push Up Power Prices? What the Data from the US, Europe and India Actually Shows

An extensive analysis of electricity markets across the United States, the European Union, Australia, and India shows that high penetration of wind and solar is not associated with higher power prices

For more than a decade, a familiar argument has echoed through political speeches and policy debates: wind and solar power are unreliable, require costly backup systems, and ultimately make electricity more expensive. From Washington to Westminster, critics of clean energy have repeatedly framed renewables as an economic burden rather than a solution.

But a growing body of real-world data tells a very different story.

An extensive analysis of electricity markets across the United States, the European Union, Australia, and India shows that high penetration of wind and solar is not associated with higher power prices. “In many cases, it is linked to below-average electricity costs, directly challenging the claim that renewables drive up consumer bills,” according to an analysis, titled The myth of renewables pushing up power prices, by Zero Carbon Analytics.

The claim versus the evidence

Opponents of renewable energy often argue that variable sources like wind and solar require “parallel systems” of fossil-fuel backup, making the overall grid more expensive. This argument has been voiced at the highest levels of politics.

In a September 2025 speech to the United Nations, US President Donald Trump described wind power as the “most expensive energy ever conceived” and said renewables are “unreliable” and “too expensive.” Similar claims have been made in the UK, where Conservative Party leader Kemi Badenoch argued that renewables and decarbonisation policies are “driving up the cost of energy” .

However, when electricity prices are examined alongside generation data, these assertions do not hold up.

“Claims that renewables drive up total costs are unsubstantiated when looking at hard data from numerous markets,” the report notes. In regions leading the transition to wind and solar, end-user electricity prices have “in most cases not climbed any faster than in places still more dependent on fossil fuels”.

Renewables versus fossil fuels: a cost reality check

At the level of generation economics, the advantage of renewables is already clear. According to the International Renewable Energy Agency (IRENA), nine out of ten new grid-scale renewable projects in 2024 produced electricity more cheaply than the cheapest new fossil-fuel alternatives.

Onshore wind now has the lowest average levelised cost of electricity (LCOE) globally at USD 0.034 per kWh, followed by solar photovoltaics at USD 0.043 per kWh. Power from new onshore wind farms is 53% cheaper than the most affordable fossil-fuel-based alternatives, IRENA reports.

Crucially, renewables paired with battery storage are also approaching cost parity with fossil fuel generation in key markets—undermining the argument that intermittency automatically means higher system costs.

The United States: cheaper power where renewables lead

In the world’s largest electricity market, the data is striking. Most US states with above-average shares of wind and solar in their electricity mix also have below-average residential power prices.

In the first nine months of 2025, three states—Iowa, South Dakota and New Mexico—generated more than 50% of their electricity from wind and solar. All three had household electricity prices below the national average. Among the ten US states with the lowest residential electricity tariffs, seven have above-average renewable integration, including Oklahoma, one of the country’s wind power leaders. The few exceptions—Louisiana, Arkansas and Washington—reflect local market dynamics rather than renewable costs.

California and Hawaii are often cited as counter-examples: both have high renewable shares and high electricity prices. But the report stresses that renewables are not the main driver.

In Hawaii, high prices stem largely from reliance on expensive imported petroleum. In California, electricity bills are pushed up by “significant and increasing wildfire-related costs” and grid infrastructure spending, according to the state’s Legislative Analyst’s Office .

Notably, despite these high absolute prices, electricity price inflation in both states has been well below the national average in 2025. While US residential prices rose 4.9% year-on-year, prices in California remained flat even as wind and solar shares increased by 5.8 percentage points. In Hawaii, residential prices fell 6.6% as renewable penetration rose further.

A separate study by Lawrence Berkeley National Laboratory reinforces this picture, finding that US power generation costs declined in real terms between 2019 and 2024, with rising bills driven instead by grid upgrades, supply-chain constraints and climate-related damage—not renewables.

Europe: breaking the link between gas and power prices

In the European Union, where the energy transition is further advanced, the relationship between renewables and prices is even clearer.

Most EU countries with above-average shares of wind and solar have below-average household electricity prices (pre-tax). Denmark, a global leader in variable renewables, exemplifies this trend.

The reason lies in how electricity markets work. In Europe, wholesale prices are set by the most expensive generator needed at any given moment—often fossil gas. In 2022, gas set day-ahead electricity prices around 60% of the time, despite supplying only 20% of electricity, according to the International Energy Agency (IEA).

As wind and solar expand, fossil fuels are needed less often, reducing their ability to dictate prices.

Spain offers a powerful case study. Wind and solar accounted for 44% of Spain’s electricity generation in the first half of 2025, compared to 31.4% across the EU. As a result, fossil fuels set Spanish power prices only 19% of the time, down from 75% in 2019. Spain’s wholesale electricity prices were 32% lower than the EU average during this period.

These savings reached consumers. Spanish households paid an average of EUR 0.18 per kWh, 13.1% below the EU average in early 2025.

The IEA estimates that EU consumers saved around EUR 100 billion between 2021 and 2023 due to new wind and solar replacing expensive fossil fuel generation—and that savings could have been 15% higher with faster deployment.

India: early transition, emerging signals

India’s power system remains dominated by coal, which supplied 73.6% of electricity in 2024, according to Ember. At this stage, the report finds no clear nationwide relationship between renewable penetration and power prices, largely because many states still have negligible wind and solar capacity.

However, early signals are emerging. In Rajasthan, where renewable deployment is more advanced, the average price paid by distribution utilities is below the national median.

A peer-reviewed study in the journal Energy Policy suggests that rising renewable integration in Madhya Pradesh could reduce power purchase costs by up to 11%, with savings increasing as demand grows and technology costs continue to fall.

Australia: complexity, but clear daily signals

Australia presents a more complex picture. In the third quarter of 2025, renewables-laggard Queensland recorded the lowest wholesale prices, while renewables-leader South Australia recorded the highest.

But the report stresses that South Australia’s high prices predate its energy transition, which only accelerated around a decade ago. Structural issues—such as a concentrated market for “on-demand” electricity and limited transmission—play a major role.

Daily data tells a different story. When wind and solar make up a large share of South Australia’s electricity mix, prices tend to fall. On days when renewables exceed 85% of generation, wholesale prices sometimes turn negative, reflecting abundant low-cost supply.

Looking ahead, Australia’s Energy Market Commission expects national residential electricity prices to fall by around 5% by 2030—but warns that prices could rise again if renewable deployment slows.

What the global data really says

Across markets with vastly different political systems, grid structures and fuel dependencies, one pattern is consistent: renewables are not driving up electricity prices.

“There is ample evidence that renewables have shielded consumers from energy price spikes during global crises,” the report points out. With the cost of wind, solar and battery storage continuing to fall, countries have an opportunity to build more resilient, affordable and stable electricity systems—provided supportive policy frameworks are in place

The myth that renewables make power expensive persists in political rhetoric. The data, however, tells a quieter but far more compelling story—one where clean energy increasingly acts as a buffer against volatility, rather than its cause.

-

Society2 months ago

Society2 months agoThe Ten-Rupee Doctor Who Sparked a Health Revolution in Kerala’s Tribal Highlands

-

COP304 months ago

COP304 months agoBrazil Cuts Emissions by 17% in 2024—Biggest Drop in 16 Years, Yet Paris Target Out of Reach

-

Earth4 months ago

Earth4 months agoData Becomes the New Oil: IEA Says AI Boom Driving Global Power Demand

-

COP304 months ago

COP304 months agoCorporate Capture: Fossil Fuel Lobbyists at COP30 Hit Record High, Outnumbering Delegates from Climate-Vulnerable Nations

-

Society2 months ago

Society2 months agoFrom Qubits to Folk Puppetry: India’s Biggest Quantum Science Communication Conclave Wraps Up in Ahmedabad

-

Space & Physics3 months ago

Space & Physics3 months agoIndian Physicists Win 2025 ICTP Prize for Breakthroughs in Quantum Many-Body Physics

-

Women In Science5 months ago

Women In Science5 months agoThe Data Don’t Lie: Women Are Still Missing from Science — But Why?

-

Health4 months ago

Health4 months agoAir Pollution Claimed 1.7 Million Indian Lives and 9.5% of GDP, Finds The Lancet