Sustainable Energy

Can India Emerge as a Global Hub for Green Hydrogen?

Promise meets policy, but challenges remain

India’s ambitious Green Hydrogen Mission aims to position the country as a global clean energy leader by 2030. However, high costs, infrastructure gaps, and regulatory challenges pose significant hurdles to its success.

At the recently held World Hydrogen Summit in Rotterdam, a major port city in the Netherlands located on the North Sea coast, India’s commitment to renewable energy and green hydrogen was on full display. Santosh Kumar Sarangi, Secretary at India’s Ministry of New and Renewable Energy, outlined an ambitious vision that has begun to gain attention not only in Asia but also across the global clean energy dialogue.

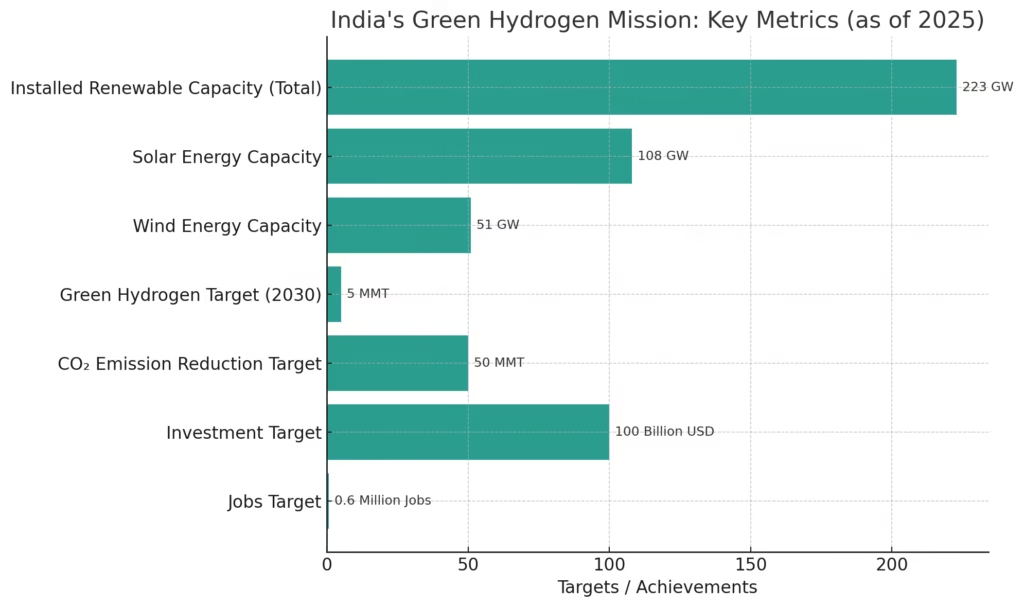

India, now boasting more than 223 GW of installed renewable energy capacity, including 108 GW from solar and 51 GW from wind, is one of the fastest-growing clean energy markets worldwide. The country aims to become energy self-reliant by 2047 and achieve net-zero carbon emissions by 2070.

To help realize this vision, India launched the National Green Hydrogen Mission in 2023 with an initial outlay of $2.4 billion USD. The mission seeks to:

- Enable domestic demand creation for green hydrogen,

- Provide incentives for electrolyzer manufacturing and hydrogen production,

- Achieve 5 million metric tonnes (MMT) of annual green hydrogen output by 2030,

- Eliminate around 50 MMT of CO₂ emissions annually,

- Attract $100 billion USD in investment, and

- Generate over 600,000 jobs.

So far, India has made significant headway. Production capacities of 862,000 tonnes per annum have been allocated to 19 companies. Another 15 firms have received approvals to manufacture electrolyzers with a combined capacity of 3,000 MW per year. Pilot projects have already begun in key sectors like steel, mobility, and shipping. Additionally, a Green Hydrogen Certification framework has been introduced to establish standards and accountability.

Three key ports have been earmarked as future green hydrogen hubs: Kandla Port, located on the west coast of India in the state of Gujarat, Paradip Port, situated on the east coast in Odisha, along the Bay of Bengal, and Thoothukudi Port (also known as Tuticorin Port), located in Tamil Nadu on the southeastern coast of India. Fifteen Indian states have also announced specific policies to encourage the green hydrogen ecosystem.

The uncomfortable truth

Despite this enthusiasm, India’s green hydrogen ambitions face serious and structural challenges — many of which are deeply rooted in the country’s energy and infrastructure landscape.

- High production costs

Green hydrogen remains significantly more expensive than grey hydrogen (produced using fossil fuels), largely due to high renewable energy and electrolyser costs. Without competitive pricing, widespread industrial adoption will lag. - Fragmented regulatory environment

India still lacks a fully standardized, national regulatory framework for green hydrogen — an issue that discourages global investors and slows deployment. - Inadequate infrastructure

India’s energy grid and hydrogen storage and distribution infrastructure are still underdeveloped. The absence of pipelines, refuelling stations, and efficient transport mechanisms could stall commercial-scale projects. - Over-reliance on policy push

While the Green Hydrogen Mission is promising, its success currently depends heavily on government subsidies and tenders. The challenge will be sustaining momentum once the initial wave of public funding tapers off. - Geopolitical competition

India is not alone in its ambitions. Countries like Australia, the EU, Japan, and the Gulf states are investing heavily in green hydrogen, often with better-established technology ecosystems and deeper financing mechanisms. India will need to move swiftly and strategically to carve out a global leadership role.

A global green hydrogen player?

India’s potential to become a global green hydrogen powerhouse is real, bolstered by its vast renewable energy capacity, policy intent, and growing private sector participation. But the road ahead requires more than vision — it demands de-risked investments, integrated regulation, infrastructure development, and international collaboration.

If India manages to overcome its internal structural constraints and leverage its strengths, it could well transition from being an energy importer to becoming a global exporter of clean energy — redefining its economic and environmental trajectory in the process.

Sustainable Energy

MIT Engineers’ Discovery Could Supercharge Hydrogen Economy

MIT engineers create a high-temperature stable palladium membrane, a breakthrough that could revolutionize clean hydrogen production

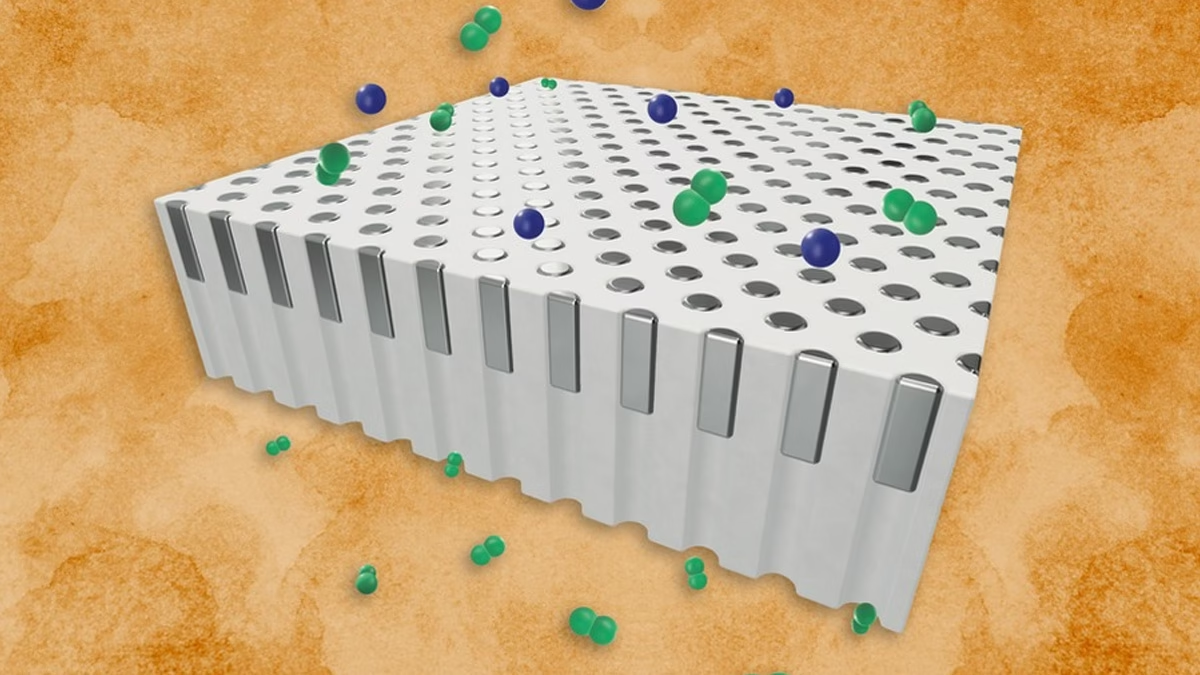

In a leap forward for hydrogen technology, engineers at the Massachusetts Institute of Technology (MIT) have developed a new palladium membrane that remains stable and efficient even at high temperatures, paving the way for cleaner, large-scale hydrogen production. This innovation could help unlock the full potential of a hydrogen-based energy economy by overcoming durability limits that have restricted palladium membranes in the past.

Palladium, a silvery metal, is prized for letting hydrogen pass while blocking all other gases, making it invaluable in filtering and generating pure hydrogen for industries like semiconductor manufacturing, food processing, and fertilizer production. Traditional palladium membranes, however, degrade if exposed to temperatures above about 800 kelvins, restricting their usefulness in high-temperature hydrogen-generating processes.

The new solution from MIT replaces the vulnerable continuous films with a design where palladium is deposited as “plugs” in the pores of a supporting material(see the generated image above). These snug-fitting plugs stay stable and continue separating hydrogen at high temperatures—unlocking opportunities for hydrogen-fuel technologies like compact steam methane reforming and ammonia cracking, which demand resilient membranes for zero-carbon fuel and energy.

“With further work on scaling and validating performance under realistic industrial feeds, the design could represent a promising route toward practical membranes for high-temperature hydrogen production,” said Lohyun Kim PhD ’24 in a media statement

Society

The Dragon and the Elephant Dance for a Cleaner World

New reports from the IEA and Ember show that China and India are leading a global turning point — where renewables now outpace fossil fuels.

In late September, EdPublica reported an inspirational story from Perinjanam, a quiet coastal village in the South Indian state Kerala, where rooftops gleam with solar panels and homes have turned into micro power plants. It was a story of how ordinary citizens, through community effort and government support, took part in a just energy transition.

That local story, seemingly small, was in fact a mirror of a far bigger movement unfolding worldwide. Now, two major global reports–one from the International Energy Agency (IEA) and another from the independent think tank Ember–confirm that the world is entering a decisive new phase in its energy transformation. Together, their findings show that 2025 is shaping up to be the turning point year: the moment when renewables not only surpassed coal but began meeting all new global electricity demand. The year will likely be remembered as the moment when the global energy transition stopped being a promise and became a measurable reality — led by the two Asian giants, China and India.

The Global Picture: IEA’s Big Forecast

‘The IEA’s Renewables 2025’ report, released on October 7, paints an extraordinary picture of growth and possibility. Despite global headwinds — including high interest rates, supply chain bottlenecks, and policy shifts — renewable energy capacity is projected to more than double by 2030, adding 4,600 gigawatts (GW) of new renewable power.

To grasp that number: it’s equivalent to building the entire current electricity generation capacity of China, the European Union, and Japan combined.

At the centre of this boom is solar photovoltaic (PV) technology, which will account for around 80% of the total growth. The IEA calls solar “the backbone of the energy transition,” driven by falling costs, faster permitting processes, and widespread adoption across emerging economies. Wind, hydropower, bioenergy, and geothermal follow closely behind, expanding capacity even as global systems adapt to higher shares of variable power.

“The growth in global renewable capacity in the coming years will be dominated by solar PV – but with wind, hydropower, bioenergy and geothermal all contributing, too,” said Fatih Birol, Executive Director of the IEA. “As renewables’ role in electricity systems rises in many countries, policymakers need to play close attention to supply chain security and grid integration challenges.”

The IEA forecasts particularly rapid progress in emerging markets. India is set to become the second-largest renewables growth market in the world, after China, reaching its ambitious 2030 targets comfortably. The report highlights new policy instruments — such as auction programs and rooftop solar incentives — that are spurring confidence across Asia, the Middle East, and Africa.

In India, the expansion of corporate power purchase agreements, utility contracts, and merchant renewable plants is also driving a quiet revolution, accounting for nearly 30% of global renewable capacity expansion to 2030.

At the same time, challenges remain. The IEA points to a worrying concentration of solar PV manufacturing in China, where over 90% of supply chain capacity for key components like polysilicon and rare earth materials is expected to remain by 2030.

Grid integration is another bottleneck. As solar and wind grow, many countries are already facing curtailments — when renewable power cannot be fed into the grid due to overload or mismatch in demand. The IEA stresses the need for urgent investment in transmission infrastructure, storage technologies, and flexible generation to prevent this momentum from being wasted.

Evidence on the Ground

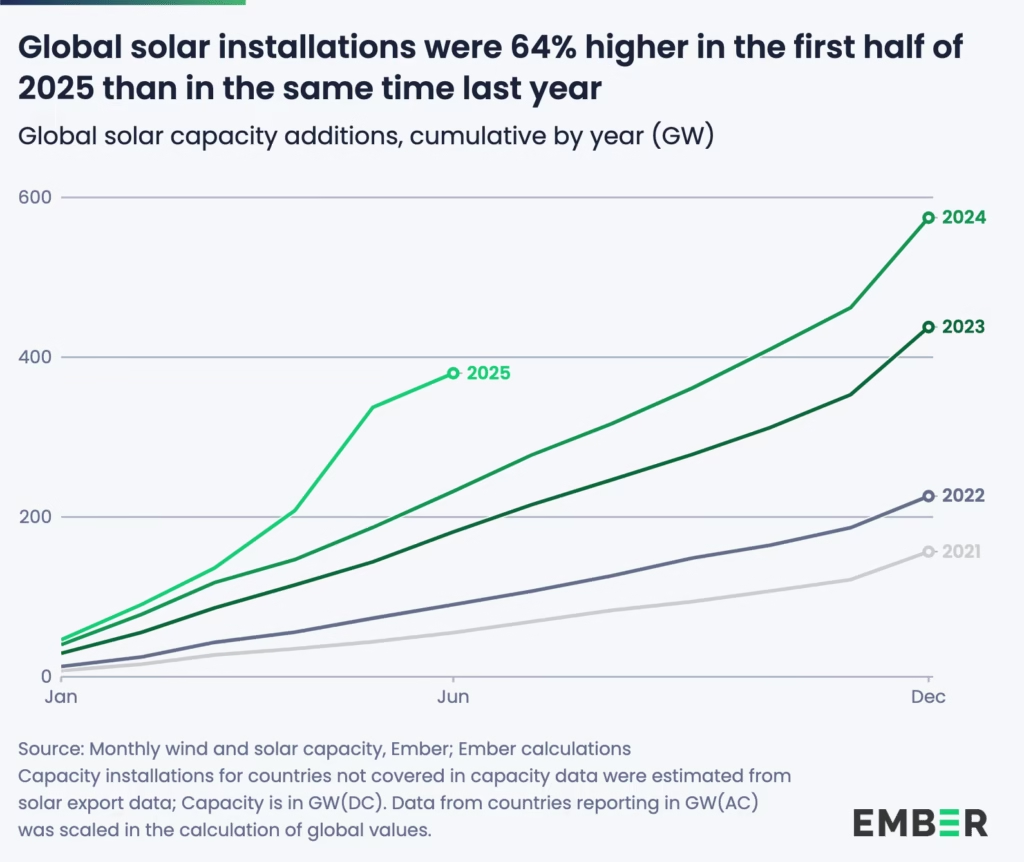

If the IEA’s report is a map of where we’re going, Ember’s Mid-Year Global Electricity Review 2025 shows where we are right now — and the signs are unmistakable.

Ember’s data, covering the first half of 2025, reveals that solar and wind met all of the world’s rising electricity demand — and even caused a slight decline in fossil fuel generation. It’s a first in recorded history.

“We are seeing the first signs of a crucial turning point,” said Małgorzata Wiatros-Motyka, Senior Electricity Analyst at Ember. “Solar and wind are now growing fast enough to meet the world’s growing appetite for electricity. This marks the beginning of a shift where clean power is keeping pace with demand growth.”

Global electricity demand rose by 2.6% in early 2025, adding about 369 terawatt-hours (TWh) compared with the same period last year. Solar alone met 83% of that rise, thanks to record generation growth of 306 TWh, a year-on-year increase of 31%. Wind contributed another 97 TWh, leading to a net decline in both coal and gas generation.

Coal generation fell 0.6% (-31 TWh) and gas 0.2% (-6 TWh), marking a combined fossil decline of 0.3% (-27 TWh). As a result, global power sector emissions fell by 0.2%, even as demand continued to grow.

Most significantly, for the first time ever, renewables generated more power than coal. Renewables supplied 5,072 TWh, overtaking coal’s 4,896 TWh — a symbolic but historic milestone.

“Solar and wind are no longer marginal technologies — they are driving the global power system forward,” said Sonia Dunlop, CEO of the Global Solar Council. “The fact that renewables have overtaken coal for the first time marks a historic shift.”

China and India Lead the Way

The two reports together highlight that the epicenter of the clean energy shift is now in Asia.

According to Ember, China’s fossil generation fell by 2% (-58.7 TWh) in the first half of 2025, as clean power growth outpaced rising electricity demand. Solar generation jumped 43% (+168 TWh), and wind grew 16% (+79 TWh), together helping cut the country’s power sector emissions by 1.7% (-47 MtCO₂).

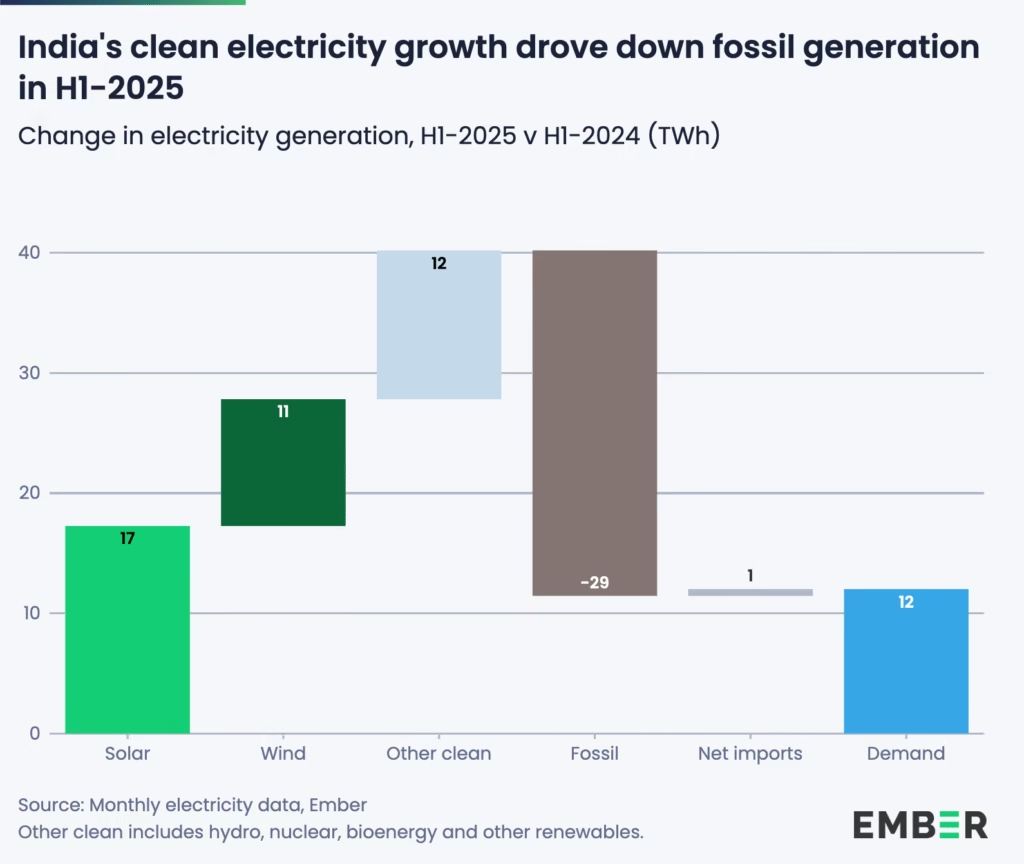

Meanwhile, India’s fossil fuel decline was even steeper in relative terms. Solar and wind generation grew at record pace — solar by 25% (+17 TWh) and wind by 29% (+11 TWh) — while electricity demand rose only 1.3%, far slower than in 2024. The result: coal use dropped 3.1% (-22 TWh) and gas by 34% (-7 TWh), leading to an estimated 3.6% fall in power sector emissions.

For both countries, these numbers align closely with the IEA’s projections. Together, China and India are now the primary engines of renewable capacity growth, demonstrating how large emerging economies can pivot toward clean energy while maintaining development momentum.

Setbacks Elsewhere

Yet progress is uneven. In the United States and European Union, fossil generation actually rose in early 2025.

In the U.S., a 3.6% rise in demand outpaced clean power additions, leading to a 17% increase in coal generation (+51 TWh), though gas use fell slightly. The EU also saw higher gas and coal use due to weaker wind and hydro output.

The IEA attributes part of this slowdown to policy uncertainty, especially in the U.S., where an early phase-out of federal tax incentives has reduced renewable growth expectations by almost 50% compared to last year’s forecast. Europe’s problem is different — a mature but strained grid facing seasonal fluctuations and low wind output.

These regional discrepancies underscore the IEA’s core message: achieving a clean power future isn’t just about building more solar farms, but about building smarter systems — integrated, flexible, and resilient.

Beyond Power

Both reports agree that while renewables are transforming electricity, their impact on transport and heating remains limited.

In transport, the IEA projects renewables’ share to rise modestly from 4% today to 6% in 2030, mostly through electric vehicles and biofuels. In heating, renewables are set to grow from 14% to 18% of global energy use over the same period.

These slower-moving sectors will define the next frontier of decarbonization — one where electrification, hydrogen, and new thermal storage technologies must play a greater role.

The Big Picture

Put together, the IEA’s forecasts and Ember’s real-world data signal that the clean energy transition has passed the point of no return.

Solar and wind are no longer simply catching up — they are now shaping global power dynamics. Their continued expansion is not only meeting new demand but beginning to displace fossil fuels outright.

“As costs of technologies continue to fall, now is the perfect moment to embrace the economic, social and health benefits that come with increased solar, wind and batteries,” said Ember’s Wiatros-Motyka.

Yet both agencies caution: to sustain this momentum, governments must expand grid capacity, diversify supply chains, and improve energy storage systems. Without these, the 2025 breakthrough could become a bottleneck.

A Symbol and a Signal

In a way, the world in 2025 looks a lot like Perinjanam did a few years ago — a place where optimism met obstacles, but the light won. What was once a village-scale transition is now a planetary transformation, proving that even small local models can foreshadow global change.

From Kerala’s rooftops to China’s vast solar parks, from India’s wind corridors to Africa’s mini-grids, the direction is unmistakable: the sun and wind are powering the next phase of human progress.

If 2024 was the year of warnings, 2025 is the year of evidence. The global energy system is finally tilting toward sustainability — not someday, but today.

Sustainable Energy

India’s Carbon Capture Push Could Risk Climate Goals, Warns New Report

India’s CCS plans could undermine its climate goals, says Climate Analytics, urging focus on renewables, storage, and decentralised clean energy.

India’s growing interest in carbon capture and storage (CCS) could undermine both its net-zero ambitions and the Paris Agreement, according to a new report from global science and policy institute Climate Analytics. The analysis warns that if Asian countries, including India, pursue a high-CCS pathway, the region could generate an additional 25 billion tonnes of greenhouse gas emissions by 2050, threatening to derail the global 1.5°C target.

The report, “The Global Climate Risks of Asia’s Expansive Carbon Capture and Storage Plans”, evaluated CCS deployment across key Asian economies including China, India, Japan, Korea, Indonesia, Thailand, Malaysia, Singapore, and Australia, which together account for more than half the world’s fossil fuel and greenhouse gas emissions

“We find a strong possibility that Asian countries could increase their support for CCS through to 2050, risking a significant lock-in of unabated fossil fuels and stranded asset costs, let alone risks to the world achieving the Paris Agreement 1.5˚C warming limit,” said report lead author James Bowen, an analyst at Climate Analytics

India’s CCS Dilemma

India is currently developing a National Carbon Capture, Utilisation and Storage (CCUS) Mission, which aims to explore technology pathways to decarbonise hard-to-abate sectors such as steel, cement, and fertiliser. However, the Climate Analytics report cautions that turning too decisively toward CCS could prove counterproductive.

It warns that if India and China “turn more decisively to future CCS dependence, it could have disastrous climate results,” as most CCS systems currently capture around 50% of emissions — far below the 95% needed to qualify as genuinely abated.

India’s CCS ambitions come at a time when its renewable energy sector is witnessing unprecedented growth. The country has already achieved over 190 GW of installed renewable capacity, including solar (88 GW), wind (47 GW), and hydropower (47 GW), and is targeting 500 GW of non-fossil capacity by 2030. According to the International Renewable Energy Agency (IRENA), India’s renewables are already among the cheapest in Asia, with utility-scale solar power generation costs at below ₹2.5 per kWh, far lower than coal or CCS-backed power.

Renewables: India’s Stronger Bet

“Deploying CCS in the power sector is, at the global average, estimated to produce a levelised cost of electricity up to at least twice that of renewables backed by storage,” the report notes

This data resonates with India’s policy shift toward decentralised clean energy. The Ministry of New and Renewable Energy (MNRE) has been driving large-scale solar park schemes while also supporting decentralised renewable energy (DRE) initiatives — from rooftop solar to community-based mini-grids — that directly power rural households, schools, and local enterprises.

Decentralised renewables are already reshaping India’s energy access landscape. According to the Council on Energy, Environment and Water (CEEW), over 100 million rural Indians could benefit from DRE systems by 2030, creating new livelihood opportunities while cutting dependence on fossil fuels. These systems also reduce transmission losses and strengthen energy security — areas where CCS offers no advantage.

Economic and Climate Risks

The Climate Analytics report argues that CCS in Asia poses both climate and economic risks. In India’s context, CCS could divert valuable capital away from sectors where renewable and electrification technologies are rapidly maturing.

“Fossil fuel energy and industrial installations with CCS are becoming increasingly uncompetitive against more economic, cheaper and more sustainable mitigation options such as renewable energy coupled with storage and electrification,” said Bowen

‘A Crossroads Moment’

Bill Hare, CEO of Climate Analytics, described Asia’s approach to CCS as “a very risky strategy, not only to the Paris Agreement, but to these economies themselves.” He added, “Asia is at a crossroads: while these countries haven’t yet gone down a high CCS route, many have tailored their CCS policies to protect their fossil fuel industry, especially in Japan, South Korea and Australia.”

For India, the choice between CCS and renewables may define its clean energy decade. Experts note that doubling down on renewables, storage, and electrification — supported by decentralised energy models — would yield faster, cheaper, and more reliable results than investing in unproven, capital-intensive CCS systems.

If India’s energy transition maintains its renewable momentum, it could become a model for the “deliberate low-CCS pathway” that Climate Analytics recommends — one that aligns with both economic pragmatism and climate responsibility.

-

Space & Physics5 months ago

Space & Physics5 months agoIs Time Travel Possible? Exploring the Science Behind the Concept

-

Earth6 months ago

Earth6 months ago122 Forests, 3.2 Million Trees: How One Man Built the World’s Largest Miyawaki Forest

-

Space & Physics6 months ago

Space & Physics6 months agoDid JWST detect “signs of life” in an alien planet?

-

Know The Scientist5 months ago

Know The Scientist5 months agoNarlikar – the rare Indian scientist who penned short stories

-

Society4 months ago

Society4 months agoShukla is now India’s first astronaut in decades to visit outer space

-

Society4 months ago

Society4 months agoAxiom-4 will see an Indian astronaut depart for outer space after 41 years

-

Earth4 months ago

Earth4 months agoWorld Environment Day 2025: “Beating plastic pollution”

-

Society6 months ago

Society6 months agoRabies, Bites, and Policy Gaps: One Woman’s Humane Fight for Kerala’s Stray Dogs