Society

INM: MIT’s Bold Push to Regain America’s Productive Edge

The ambitious initiative aims at reinvigorating U.S. manufacturing with cutting-edge innovation

In a move to reshape the future of American industry, the Massachusetts Institute of Technology (MIT) has launched its Initiative for New Manufacturing (INM), an Institute-wide effort aimed at revitalizing U.S. manufacturing through next-generation technologies, research, education, and deep collaboration with industry.

Announced today, INM seeks to strengthen key sectors of the U.S. economy and spark nationwide job creation. The initiative will bring together MIT’s extensive research capabilities and educational resources to help companies of all sizes increase productivity and build a more resilient and human-centered manufacturing landscape.

“We want to work with firms big and small, in cities, small towns and everywhere in between, to help them adopt new approaches for increased productivity,” MIT President Sally A. Kornbluth wrote in a letter to the Institute community this morning. “We want to deliberately design high-quality, human-centered manufacturing jobs that bring new life to communities across the country.”

“We want to work with firms big and small, in cities, small towns and everywhere in between, to help them adopt new approaches for increased productivity

Kornbluth emphasized the significance of the effort, stating in a media statement: “Helping America build a future of new manufacturing is a perfect job for MIT — and I’m convinced that there is no more important work we can do to meet the moment and serve the nation now.”

Industry Collaboration

INM has already attracted strong industry support, with its first five founding consortium members — Amgen, GE Vernova, PTC, Siemens, and Sanofi — joining forces to fund initial research projects, particularly in the area of artificial intelligence for manufacturing.

“There is tremendous opportunity to bring together a vibrant community working across every scale — from nanotechnology to large-scale manufacturing,” said Anantha Chandrakasan, MIT’s chief innovation and strategy officer and dean of engineering. “MIT is uniquely positioned to harness the transformative power of digital tools and AI to shape the future of manufacturing.”

The initiative will support research, education, and real-world applications — including new manufacturing labs, a “factory observatory” program to connect students with live production sites, and thematic pillars ranging from semiconductors and biomanufacturing to defense and aviation.

Workforce development is also central to INM’s mission. It will include TechAMP, a program designed to bridge the gap between technicians and engineers through collaboration with community colleges, along with AI-powered teaching tools and expanded manufacturing education on campus.

The initiative is co-directed by three MIT faculty: John Hart, head of mechanical engineering; Suzanne Berger, an Institute Professor and political scientist; and Chris Love, professor of chemical engineering. Julie Diop serves as executive director.

At a recent MIT symposium titled “A Vision for New Manufacturing,” Berger underscored the urgency of the moment: “The rationale for growing and transforming U.S. manufacturing has never been more urgent than it is today. What we are trying to build at MIT now is not just another research project. … Together, with people in this room and outside this room, we’re trying to change what’s happening in our country.”

Love added: “We need to think about the importance of manufacturing again, because it is what brings product ideas to people… There is a real urgency about this issue for both economic prosperity and creating jobs.”

Echoing the sentiment, Hart emphasized the long-term significance of the initiative: “While manufacturing feels very timely today, it is of enduring importance… Working with industry — from small to large companies, and from young startups to industrial giants — will be instrumental to creating impact and realizing the vision for new manufacturing.”

A Continuum of Commitment

INM builds on a legacy of MIT initiatives aimed at supporting manufacturing, including the 1989 book Made in America, the Production in the Innovation Economy project, and The Engine, a venture fund launched in 2016 to back hardware-based startups.

As Kornbluth noted in her letter, “We want to reimagine manufacturing technologies and systems to advance fields like energy production, health care, computing, transportation, consumer products, and more… and we want to reach well beyond the shop floor to tackle challenges like how to make supply chains more resilient, and how to inform public policy to foster a broad, healthy manufacturing ecosystem that can drive decades of innovation and growth.”

With its launch, MIT’s Initiative for New Manufacturing marks a renewed commitment to restoring American manufacturing leadership through innovation, collaboration, and education — aimed squarely at building a stronger, more equitable industrial future.

Society

The Dragon and the Elephant Dance for a Cleaner World

New reports from the IEA and Ember show that China and India are leading a global turning point — where renewables now outpace fossil fuels.

In late September, EdPublica reported an inspirational story from Perinjanam, a quiet coastal village in the South Indian state Kerala, where rooftops gleam with solar panels and homes have turned into micro power plants. It was a story of how ordinary citizens, through community effort and government support, took part in a just energy transition.

That local story, seemingly small, was in fact a mirror of a far bigger movement unfolding worldwide. Now, two major global reports–one from the International Energy Agency (IEA) and another from the independent think tank Ember–confirm that the world is entering a decisive new phase in its energy transformation. Together, their findings show that 2025 is shaping up to be the turning point year: the moment when renewables not only surpassed coal but began meeting all new global electricity demand. The year will likely be remembered as the moment when the global energy transition stopped being a promise and became a measurable reality — led by the two Asian giants, China and India.

The Global Picture: IEA’s Big Forecast

‘The IEA’s Renewables 2025’ report, released on October 7, paints an extraordinary picture of growth and possibility. Despite global headwinds — including high interest rates, supply chain bottlenecks, and policy shifts — renewable energy capacity is projected to more than double by 2030, adding 4,600 gigawatts (GW) of new renewable power.

To grasp that number: it’s equivalent to building the entire current electricity generation capacity of China, the European Union, and Japan combined.

At the centre of this boom is solar photovoltaic (PV) technology, which will account for around 80% of the total growth. The IEA calls solar “the backbone of the energy transition,” driven by falling costs, faster permitting processes, and widespread adoption across emerging economies. Wind, hydropower, bioenergy, and geothermal follow closely behind, expanding capacity even as global systems adapt to higher shares of variable power.

“The growth in global renewable capacity in the coming years will be dominated by solar PV – but with wind, hydropower, bioenergy and geothermal all contributing, too,” said Fatih Birol, Executive Director of the IEA. “As renewables’ role in electricity systems rises in many countries, policymakers need to play close attention to supply chain security and grid integration challenges.”

The IEA forecasts particularly rapid progress in emerging markets. India is set to become the second-largest renewables growth market in the world, after China, reaching its ambitious 2030 targets comfortably. The report highlights new policy instruments — such as auction programs and rooftop solar incentives — that are spurring confidence across Asia, the Middle East, and Africa.

In India, the expansion of corporate power purchase agreements, utility contracts, and merchant renewable plants is also driving a quiet revolution, accounting for nearly 30% of global renewable capacity expansion to 2030.

At the same time, challenges remain. The IEA points to a worrying concentration of solar PV manufacturing in China, where over 90% of supply chain capacity for key components like polysilicon and rare earth materials is expected to remain by 2030.

Grid integration is another bottleneck. As solar and wind grow, many countries are already facing curtailments — when renewable power cannot be fed into the grid due to overload or mismatch in demand. The IEA stresses the need for urgent investment in transmission infrastructure, storage technologies, and flexible generation to prevent this momentum from being wasted.

Evidence on the Ground

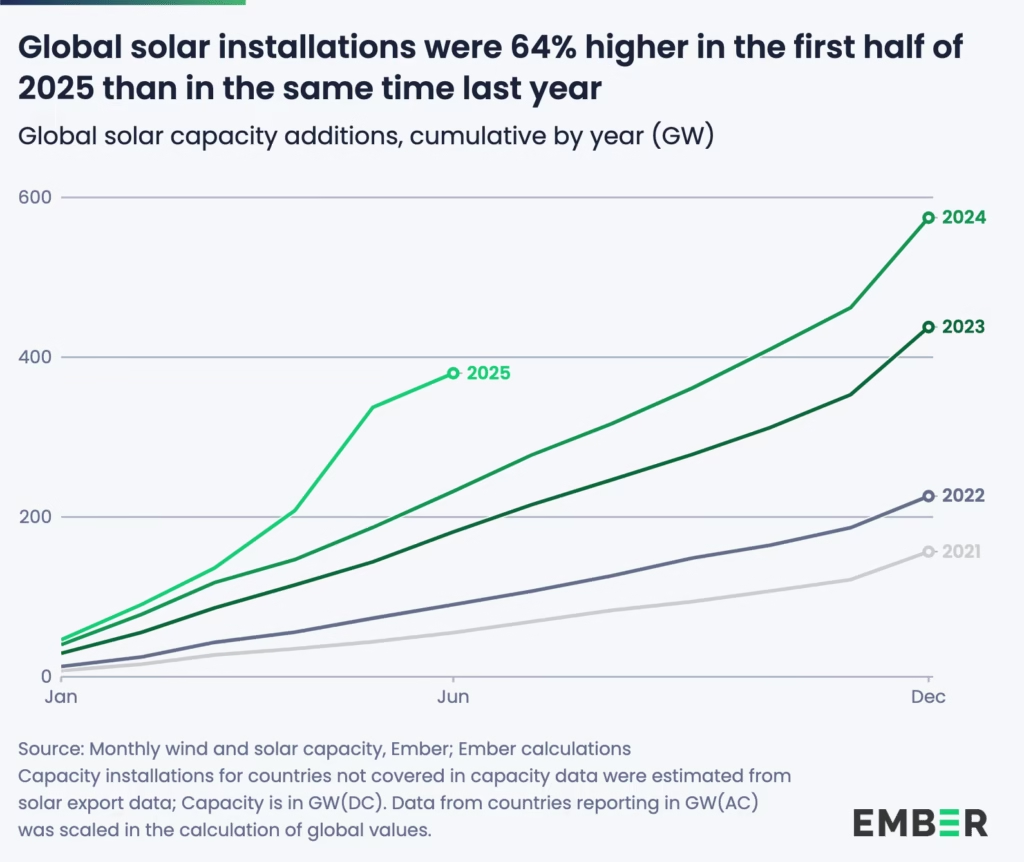

If the IEA’s report is a map of where we’re going, Ember’s Mid-Year Global Electricity Review 2025 shows where we are right now — and the signs are unmistakable.

Ember’s data, covering the first half of 2025, reveals that solar and wind met all of the world’s rising electricity demand — and even caused a slight decline in fossil fuel generation. It’s a first in recorded history.

“We are seeing the first signs of a crucial turning point,” said Małgorzata Wiatros-Motyka, Senior Electricity Analyst at Ember. “Solar and wind are now growing fast enough to meet the world’s growing appetite for electricity. This marks the beginning of a shift where clean power is keeping pace with demand growth.”

Global electricity demand rose by 2.6% in early 2025, adding about 369 terawatt-hours (TWh) compared with the same period last year. Solar alone met 83% of that rise, thanks to record generation growth of 306 TWh, a year-on-year increase of 31%. Wind contributed another 97 TWh, leading to a net decline in both coal and gas generation.

Coal generation fell 0.6% (-31 TWh) and gas 0.2% (-6 TWh), marking a combined fossil decline of 0.3% (-27 TWh). As a result, global power sector emissions fell by 0.2%, even as demand continued to grow.

Most significantly, for the first time ever, renewables generated more power than coal. Renewables supplied 5,072 TWh, overtaking coal’s 4,896 TWh — a symbolic but historic milestone.

“Solar and wind are no longer marginal technologies — they are driving the global power system forward,” said Sonia Dunlop, CEO of the Global Solar Council. “The fact that renewables have overtaken coal for the first time marks a historic shift.”

China and India Lead the Way

The two reports together highlight that the epicenter of the clean energy shift is now in Asia.

According to Ember, China’s fossil generation fell by 2% (-58.7 TWh) in the first half of 2025, as clean power growth outpaced rising electricity demand. Solar generation jumped 43% (+168 TWh), and wind grew 16% (+79 TWh), together helping cut the country’s power sector emissions by 1.7% (-47 MtCO₂).

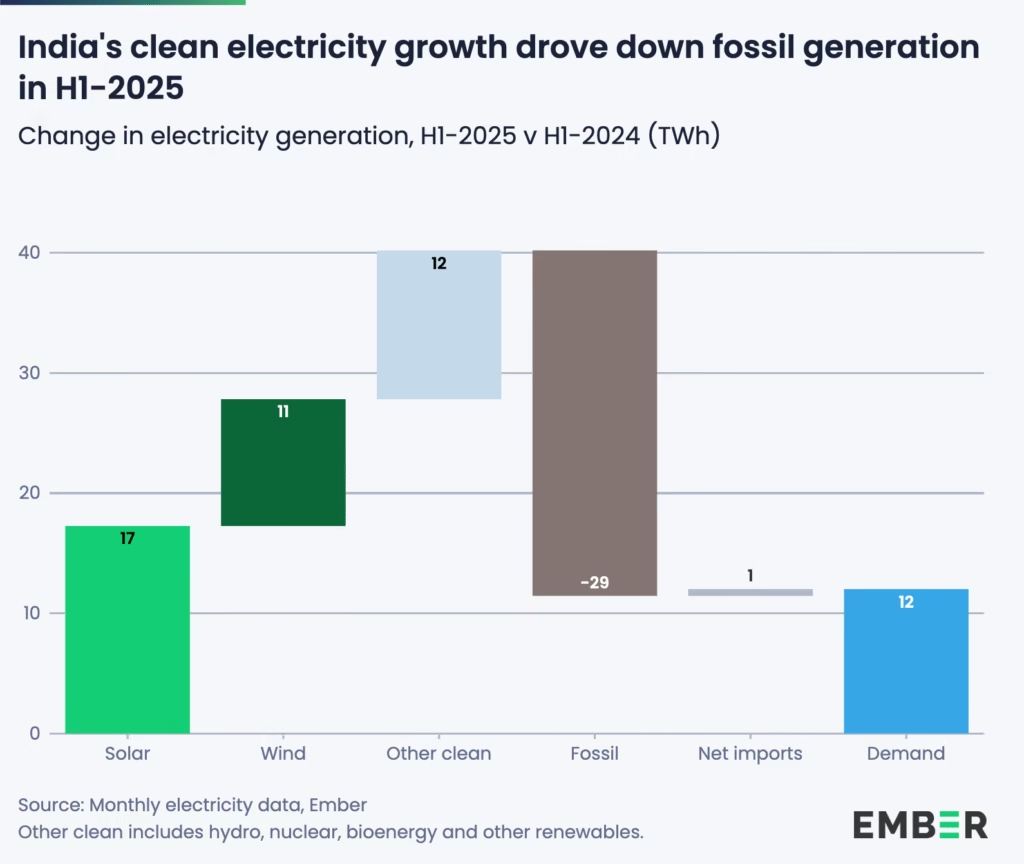

Meanwhile, India’s fossil fuel decline was even steeper in relative terms. Solar and wind generation grew at record pace — solar by 25% (+17 TWh) and wind by 29% (+11 TWh) — while electricity demand rose only 1.3%, far slower than in 2024. The result: coal use dropped 3.1% (-22 TWh) and gas by 34% (-7 TWh), leading to an estimated 3.6% fall in power sector emissions.

For both countries, these numbers align closely with the IEA’s projections. Together, China and India are now the primary engines of renewable capacity growth, demonstrating how large emerging economies can pivot toward clean energy while maintaining development momentum.

Setbacks Elsewhere

Yet progress is uneven. In the United States and European Union, fossil generation actually rose in early 2025.

In the U.S., a 3.6% rise in demand outpaced clean power additions, leading to a 17% increase in coal generation (+51 TWh), though gas use fell slightly. The EU also saw higher gas and coal use due to weaker wind and hydro output.

The IEA attributes part of this slowdown to policy uncertainty, especially in the U.S., where an early phase-out of federal tax incentives has reduced renewable growth expectations by almost 50% compared to last year’s forecast. Europe’s problem is different — a mature but strained grid facing seasonal fluctuations and low wind output.

These regional discrepancies underscore the IEA’s core message: achieving a clean power future isn’t just about building more solar farms, but about building smarter systems — integrated, flexible, and resilient.

Beyond Power

Both reports agree that while renewables are transforming electricity, their impact on transport and heating remains limited.

In transport, the IEA projects renewables’ share to rise modestly from 4% today to 6% in 2030, mostly through electric vehicles and biofuels. In heating, renewables are set to grow from 14% to 18% of global energy use over the same period.

These slower-moving sectors will define the next frontier of decarbonization — one where electrification, hydrogen, and new thermal storage technologies must play a greater role.

The Big Picture

Put together, the IEA’s forecasts and Ember’s real-world data signal that the clean energy transition has passed the point of no return.

Solar and wind are no longer simply catching up — they are now shaping global power dynamics. Their continued expansion is not only meeting new demand but beginning to displace fossil fuels outright.

“As costs of technologies continue to fall, now is the perfect moment to embrace the economic, social and health benefits that come with increased solar, wind and batteries,” said Ember’s Wiatros-Motyka.

Yet both agencies caution: to sustain this momentum, governments must expand grid capacity, diversify supply chains, and improve energy storage systems. Without these, the 2025 breakthrough could become a bottleneck.

A Symbol and a Signal

In a way, the world in 2025 looks a lot like Perinjanam did a few years ago — a place where optimism met obstacles, but the light won. What was once a village-scale transition is now a planetary transformation, proving that even small local models can foreshadow global change.

From Kerala’s rooftops to China’s vast solar parks, from India’s wind corridors to Africa’s mini-grids, the direction is unmistakable: the sun and wind are powering the next phase of human progress.

If 2024 was the year of warnings, 2025 is the year of evidence. The global energy system is finally tilting toward sustainability — not someday, but today.

Society

FIFA, ICC and F1 accused of greenwashing as Aramco sponsorships clash with climate goals

Human-rights and climate groups urge FIFA, F1, and ICC to cut Aramco sponsorships, warning deals clash with Paris climate goals.

Ten human-rights and climate groups have written to FIFA, Formula 1 and the ICC demanding they justify their multi-million-dollar sponsorship deals with Saudi Aramco, warning that the arrangements undermine both international climate targets and the sports’ own sustainability commitments.

The letters argue that accepting money from the world’s biggest oil producer while signing up to UN sport-for-climate initiatives exposes a glaring credibility gap. Aramco has repeatedly declared its intent to expand oil and gas production, a stance that campaigners say is fundamentally incompatible with rapid decarbonisation.

Frank Huisingh of Fossil Free Football said, in a statement, “FIFA and other sports bodies cannot claim to champion human rights or sustainability while they sell their platform to a big polluter — especially when that polluter uses our favourite sports to promote fossil fuels and stop the climate action we all need.”

Maryam Aldossari of ALQST warned, “Sports bodies that give Aramco a global audience are helping to strengthen the country’s harsh autocratic system, where criticism of the government is punishable by prison, and a journalist was executed earlier this year.”

New Zealand international Katie Rood added, “the leaders of sports like FIFA and Formula 1 claim that they care about the planet, but it’s impossible to reconcile these commitments with taking money from the largest oil and gas company in the world.”

Critics say Aramco’s growing sports sponsorships are part of a broader strategy to safeguard its status as the world’s largest oil and gas producer. The company has built a global sponsorship portfolio worth more than $1.3 billion across more than 900 agreements. In the coming years, its brand will take center stage as a “Major Worldwide Partner” for the 2026 and 2027 FIFA World Cups, while also serving as a lead sponsor of the 2026 T20 World Cup in India and Sri Lanka.

Sofie Junge Pedersen, Danish international with 88 caps said: “The choice to partner with Aramco helps the Saudi regime distract from its harmful treatment of women and the planet. Values are not just words to write on a page – you need to live them and stand by them. FIFA needs to stand by its set of values on human rights and sustainability, which they are not doing with this sponsorship.”

Wider context

The campaigners’ concerns build on a UN communication issued in August 2023, when Special Rapporteurs cautioned governments and financial institutions that their relationships with Aramco could breach international human-rights law. Although the sports bodies were not directly addressed, activists say the logic applies: by platforming Aramco, global sport risks complicity in the same climate-driven harms.

The controversy underlines sport’s climate credibility crisis. Global governing bodies have pledged to align with the Paris Agreement, but fossil-fuel sponsorships cut directly against those promises. The question now is whether commercial deals worth hundreds of millions outweigh the reputational cost of being seen as enablers of greenwashing.

Society

Big Fashion’s Fossil-Fuel Addiction: The Clean Heat Opportunity Being Ignored

Despite having a combined turnover of over $2.7 trillion, major fashion brands are lagging on electrification and renewable energy targets, risking both the environment and human rights.

The global fashion industry, worth a staggering $2.7 trillion, is still clinging to coal and other fossil fuels, putting both the planet and garment workers at risk, according to a damning new report by Fashion Revolution.

Fashion Revolution is a leading global movement advocating for a more ethical and sustainable fashion industry. With a presence in 76 countries, they unite citizens, industry leaders, and policymakers through groundbreaking research, education, and powerful advocacy, driving change from the ground up

The second edition of ‘What Fuels Fashion?’ reveals that despite glossy sustainability claims, most of the world’s biggest fashion brands are failing to tackle their most urgent climate responsibility: switching to clean heat.

‘Clean Heat’ is the use of renewables to meet manufacturing’s thermal energy demand, through solutions such as heat pumps and electric boilers

‘Clean Heat’ is the use of renewables to meet manufacturing’s thermal energy demand, through solutions such as heat pumps and electric boilers. This renewable, fossil-free energy could slash emissions from textile production while protecting workers from life-threatening heat stress.

The International Energy Agency warns that to achieve climate commitments, fashion brands need to help their supply chains shift entirely to electric and renewable energy by 2040. Meanwhile, a new study by the American Lung Association highlights the health and climate benefits of replacing fossil-fuelled industrial boilers with heat pumps.

Yet the report’s findings paint a bleak picture. Only 18% of brands have coal phase-out targets for textile processing, and none account for purchased steam — a major emissions source. A paltry 7% disclose any efforts to electrify high-heat processes, even though proven technologies exist, the report points out.

Read>> Why Kerala Has Struggled to Replicate Perinjanam’s Solar Success

90 brands scored zero on supply chain traceability, with many publicly listed — a glaring accountability gap for investors.

“Fashion brands love to promote innovative new products, but the Victorian-era reality of burning coal and wood to manufacture them is quietly swept under the rug,” said Ruth MacGilp, Fashion Campaign Manager at Action Speaks Louder.

The report also highlights a human cost often ignored in sustainability PR campaigns. As global temperatures rise, garment workers face increasingly unsafe factory conditions — yet not a single brand discloses factory-level heat and humidity data. “The path to decarbonisation will be won or lost by how fashion tackles heat,” warned Liv Simpliciano, Head of Policy & Research at Fashion Revolution.

Some high-profile names fared particularly badly. 39 major brands, including Forever 21, Reebok, Ted Baker, and Van Heusen, scored zero. At the top end, H&M (71%) and Puma (51%) led the rankings, but even leaders fell far short of full marks.

With fewer than a third of brands showing actual emissions reductions, and just 6% investing in renewable energy or efficiency, campaigners argue that fashion’s sustainability drive remains more marketing than meaningful change.

“The textiles industry has the chance to lead,” said Jan Rosenow, Professor of Energy and Climate Policy at Oxford University. “Process heat rarely exceeds 250°C — the technical barriers to moving away from fossil fuels are low. Companies must commit now.”

The report concludes with a blunt warning: unless brands embrace clean heat, they will continue to fuel climate breakdown while exposing workers to unsafe conditions — a toxic combination that could unravel fashion’s future far faster than fleeting trends ever could.

-

Space & Physics5 months ago

Space & Physics5 months agoIs Time Travel Possible? Exploring the Science Behind the Concept

-

Earth6 months ago

Earth6 months ago122 Forests, 3.2 Million Trees: How One Man Built the World’s Largest Miyawaki Forest

-

Space & Physics6 months ago

Space & Physics6 months agoDid JWST detect “signs of life” in an alien planet?

-

Know The Scientist5 months ago

Know The Scientist5 months agoNarlikar – the rare Indian scientist who penned short stories

-

Society4 months ago

Society4 months agoShukla is now India’s first astronaut in decades to visit outer space

-

Society4 months ago

Society4 months agoAxiom-4 will see an Indian astronaut depart for outer space after 41 years

-

Earth4 months ago

Earth4 months agoWorld Environment Day 2025: “Beating plastic pollution”

-

Society6 months ago

Society6 months agoRabies, Bites, and Policy Gaps: One Woman’s Humane Fight for Kerala’s Stray Dogs