Sustainable Energy

Gujarat, Kerala Top India’s Rooftop Solar Race as PMSGY Expands, Yet Financial Bottlenecks Linger

India’s rooftop solar mission is gaining pace under PMSGY, led by Gujarat and Kerala. Yet, limited financing access and supply chain gaps continue to test its momentum

India’s flagship Pradhan Mantri Surya Ghar Yojana (PMSGY) has given a major push to the country’s residential rooftop solar (RTS) sector, adding nearly 4.9 gigawatts (GW) of new capacity in just over a year since its launch. Yet, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics, challenges in financing, supply chains, and consumer awareness continue to slow progress toward national targets.

The report, Advancing Residential Rooftop Solar Adoption in India under PM Surya Ghar Yojana, notes that as of July 2025, over 57.9 lakh households have applied for rooftop solar systems under the scheme. Despite this surge — a fourfold rise in applications since March 2024 — only 22.7% have translated into actual installations.

“PMSGY has steadily expanded its policy framework to speed up residential rooftop solar adoption. Since 2024, it has rolled out a nationwide capacity-building programme to train over three lakh people and help vendors, utilities and financiers upskill,” says, Jyoti Gulia, Founder, JMK Research.

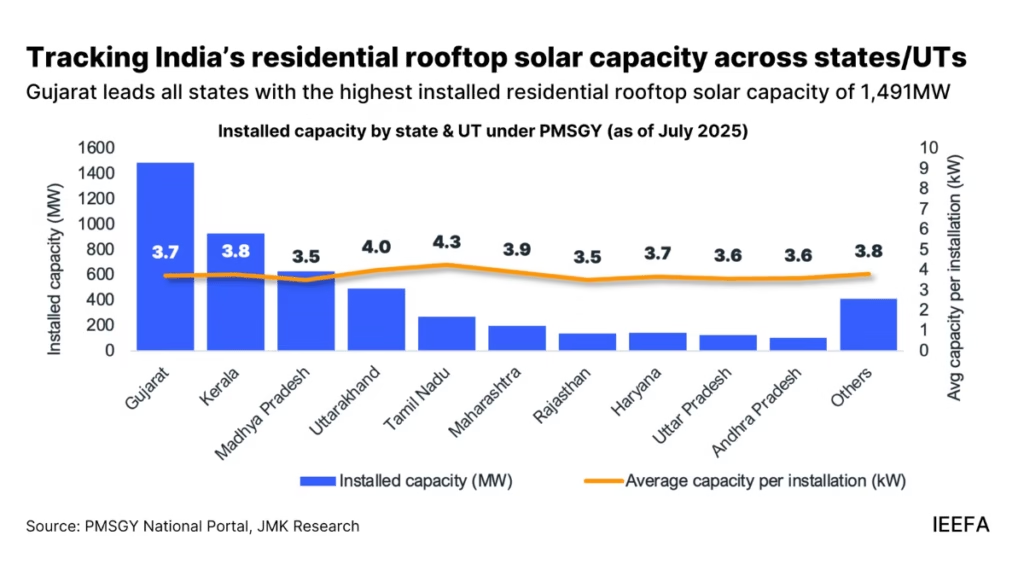

Gujarat, Kerala Lead the Way

Gujarat has emerged as the clear front-runner, boasting 1,491 MW of installed residential rooftop capacity — the highest in the country. Maharashtra, Uttar Pradesh, Kerala, and Rajasthan follow, together accounting for more than 77% of total installations under the programme.

These states’ success is credited to their mature solar ecosystems, strong vendor bases, and high consumer awareness. Gujarat and Kerala, for instance, have achieved conversion ratios of over 65%, far above the national average.

However, Kerala’s success has been uneven. As highlighted in an EdPublica investigation — Why Kerala Has Struggled to Replicate Perinjanam’s Solar Success — the state’s progress has been shaped by strong community-led models like Perinjanam’s solar initiative, but replication across districts has faced institutional and financial hurdles. Local leadership and decentralised governance, experts argue, remain key to scaling up such success stories statewide.

Financing, Awareness, and Supply Chain Barriers

Despite the scheme’s momentum, several bottlenecks remain. The report highlights that low consumer awareness of financing options, complicated loan procedures, and technical glitches in the grievance redressal system hinder wider adoption.

“However, low consumer awareness and access to finance remain significant barriers to the adoption of rooftop solar. Outdated perceptions of high upfront costs and maintenance persist, especially in rural areas,” says Prabhakar Sharma, Senior Consultant, JMK Research.

Fragmented supply chains for critical components such as solar panels, inverters, and mounting structures have also caused project delays.

“Establishing clear, time-bound rooftop solar capacity targets at the state level is essential for creating a coherent vision and ensuring effective policy execution,” Vibhuti Garg, Director, IEEFA – South Asia, points out.

Need for Stronger Local Implementation

The report notes that although a grievance redressal mechanism has been set up under PMSGY, its effectiveness remains limited. “PMSGY should establish a district-level escalation matrix so that subsidy disbursement delays, incorrect data entries or portal malfunctions can be routed beyond the DISCOM or portal level,” Aman Gupta, Research Associate, JMK Research says.

Analysts recommend creating state and district facilitation cells to guide consumers through the application and subsidy process, along with extensive public awareness campaigns to educate households about long-term savings from rooftop solar.

Standardisation and Plug-and-Play Solutions

The report stresses the need for standardised rooftop solar kits that integrate panels, inverters, and cables into ready-to-install packages.

“The rooftop solar market continues to face fragmented quality and weak end-to-end guarantees, challenges that standardised plug-and-play solutions can resolve,” Prabhakar Sharma adds.

Promoting the commoditisation of rooftop systems, the authors argue, can help speed up installations and minimise delays.

Beyond Subsidies: Building a Solar-Ready Ecosystem

While the central government has disbursed over INR 9,280 crore (US$1.05 billion) in subsidies so far — just 14% of the total allocated under PMSGY — experts caution that subsidies alone won’t ensure success.

“The long-term success of PMSGY hinges not only on the provision of subsidies but also on its ability to institutionalise streamlined digital processes, standardised product solutions, and consumer-centric support systems,” according to the Report authors’ conclusion.

To meet the ambitious 30GW rooftop solar target by FY2027, India will need to bridge the financing gap, build local capacity, and simplify consumer experiences — transforming rooftops across urban and rural India into decentralised clean energy generators.

Earth

India and China to Peak Coal Emissions by 2030 — and India’s Data Proves It’s Economically Inevitable

New analysis finds China, India, and Indonesia—the world’s top coal users—can peak power-sector emissions by 2030, marking a global climate turning point.

In what could mark a historic global energy shift, new analysis from the Centre for Research on Energy and Clean Air (CREA) reveals that the world’s three largest coal growth markets, China, India, and Indonesia, are on track to peak their power sector emissions by 2030. Together, these nations accounted for a staggering 73% of global coal consumption in 2024, making this potential turnaround a defining moment in the fight against climate change

China: Clean Energy Outpaces Demand

China has already reached a milestone that once seemed improbable: clean energy growth has outpaced the rise in electricity demand, leading to a fall in coal power emissions since early 2024

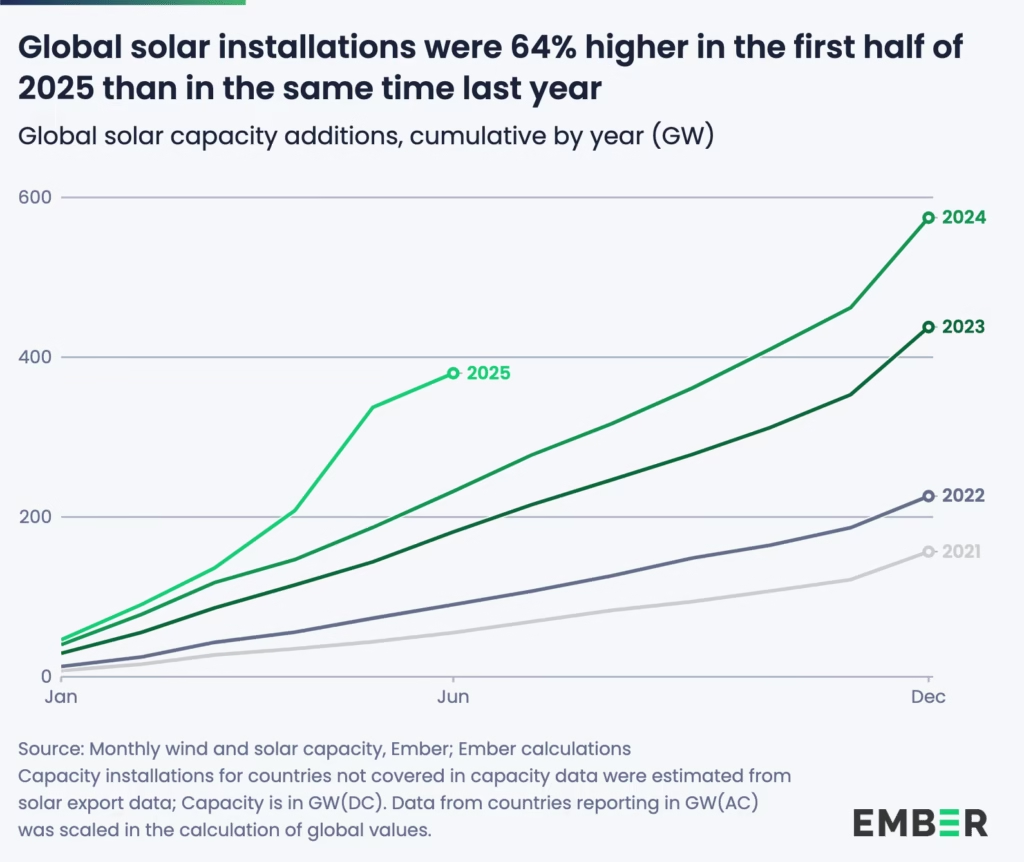

In 2024 alone, the country added 277 GW of solar capacity and 80 GW of wind, with an additional 212 GW of solar in just the first half of 2025. “Since I announced China’s goals for carbon peaking and carbon neutrality five years ago, China has built the world’s largest and fastest-growing renewable energy system,” President Xi Jinping declared earlier this year.

If current trends continue, China’s coal use may never return to previous highs. But sustaining this progress depends on meeting its 2035 clean energy targets and avoiding a slowdown in installations.

“China has already added enough new clean electricity generation to cover all new demand growth, and power sector coal use and emissions have been falling since 2024 as a result,” said Lauri Myllyvirta, CREA’s Lead Analyst, in the report.

India: Rapid Clean Energy Expansion Takes Off

India’s clean electricity boom, once stalled, has roared to life. In 2024, the country added a record 29 GW of non-fossil capacity, and by mid-2025, that pace had surged by 69% year-on-year.

With Prime Minister Narendra Modi’s 500 GW clean power target by 2030, India is already more than halfway there. The nation’s growing domestic solar manufacturing base—118 GW of module capacity and 27 GW of solar cells—is transforming it into a global solar hub.

“Meeting India’s 500 GW non-fossil power capacity target could peak coal power before 2030,” said Manoj Kumar, CREA Analyst. “Strengthening grid flexibility, storage, and transmission will be key to sustaining this momentum.”

India’s Coal Economics Have Flipped

A new report from Ember (October 2025) adds powerful economic validation to CREA’s projection.

Titled “Adding coal beyond the National Electricity Plan 2032 targets is uneconomical for India,” Ember’s findings confirm that building more coal plants is no longer cost-effective or necessary.

Ember’s least-cost operations model shows that if India meets its National Electricity Plan (NEP) 2032 targets for renewables and storage:

- 10% of new coal units built after FY2024–25 will be completely unutilised by 2031–32

- 25% of the coal fleet will be heavily underutilised

- Coal-based electricity will become 25% more expensive by 2031–32 as utilisation drops

“Building coal beyond the current pipeline is neither necessary nor economical for the country,” said Neshwin Rodrigues, Senior Energy Analyst at Ember.

Ember’s study aligns with CREA’s broader conclusion — India’s clean energy growth is not only sufficient to meet new demand but also the cheapest and most reliable path forward.

Indonesia: Big Solar Vision vs. Fossil Reality

Indonesia’s new president Prabowo Subianto has laid out a bold plan for 100 GW of solar capacity and a 100% renewable power system by 2035. If fully realized, this initiative alone could cause coal power to peak by 2030.

However, Indonesia’s official power plan—the RUPTL 2025–34—still leans heavily on new coal and gas plants. CREA’s analysis warns that without strong oversight and power market reforms, Indonesia’s solar revolution could stall.

“The real opportunity lies in translating this vision into a concrete delivery roadmap that positions clean energy to dominate new capacity additions,” said Katherine Hasan, CREA Analyst.

The Economics of Change

Across all three nations, clean energy’s economic edge is becoming undeniable.

The cost of solar panels has dropped 60% since 2022, while battery storage prices fell 50% between 2022 and 2024. In China, clean energy industries now make up over 10% of GDP, fuelling jobs and innovation. India’s solar bids are now cheaper than coal tariffs, and Indonesia’s strong sunlight potential could soon make solar the most cost-effective option for households.

CREA’s report also highlights that these clean energy drives align with national priorities: energy independence, industrial growth, and improved air quality.

A Common Threat: Coal’s Last Stand

Despite rapid progress, the report warns of a looming obstacle—new coal projects. China currently has 230 GW of coal-fired power under construction, and India plans 100 GW more by 2035. “Unchecked coal power expansion risks creating powerful vested interests that could delay the energy transition,” Myllyvirta cautioned. A rapid phase-down post-2030, he added, could cut emissions equivalent to India’s entire 2019 CO2 output.

A Turning Point for BRICS and the Planet

If successful, China, India, and Indonesia would join Brazil, South Africa, the UAE, and Ethiopia—other BRICS members that have already peaked their power emissions—transforming the bloc into an unexpected climate leader.

But the next few years are pivotal. Whether these nations sustain their clean energy momentum or fall back into fossil dependence could determine the world’s ability to meet the goals of the Paris Agreement.

As CREA concludes in the report, the road to peaking emissions is now open—what remains is the political will to walk it.

Sustainable Energy

MIT Engineers’ Discovery Could Supercharge Hydrogen Economy

MIT engineers create a high-temperature stable palladium membrane, a breakthrough that could revolutionize clean hydrogen production

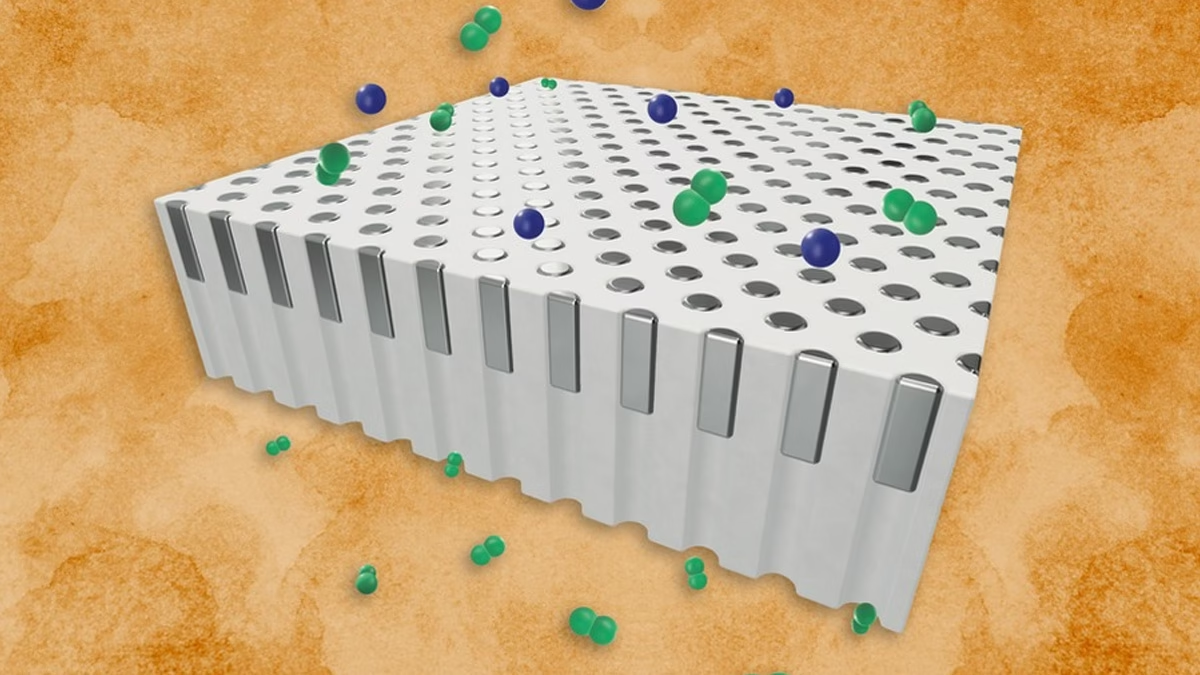

In a leap forward for hydrogen technology, engineers at the Massachusetts Institute of Technology (MIT) have developed a new palladium membrane that remains stable and efficient even at high temperatures, paving the way for cleaner, large-scale hydrogen production. This innovation could help unlock the full potential of a hydrogen-based energy economy by overcoming durability limits that have restricted palladium membranes in the past.

Palladium, a silvery metal, is prized for letting hydrogen pass while blocking all other gases, making it invaluable in filtering and generating pure hydrogen for industries like semiconductor manufacturing, food processing, and fertilizer production. Traditional palladium membranes, however, degrade if exposed to temperatures above about 800 kelvins, restricting their usefulness in high-temperature hydrogen-generating processes.

The new solution from MIT replaces the vulnerable continuous films with a design where palladium is deposited as “plugs” in the pores of a supporting material(see the generated image above). These snug-fitting plugs stay stable and continue separating hydrogen at high temperatures—unlocking opportunities for hydrogen-fuel technologies like compact steam methane reforming and ammonia cracking, which demand resilient membranes for zero-carbon fuel and energy.

“With further work on scaling and validating performance under realistic industrial feeds, the design could represent a promising route toward practical membranes for high-temperature hydrogen production,” said Lohyun Kim PhD ’24 in a media statement

Society

The Dragon and the Elephant Dance for a Cleaner World

New reports from the IEA and Ember show that China and India are leading a global turning point — where renewables now outpace fossil fuels.

In late September, EdPublica reported an inspirational story from Perinjanam, a quiet coastal village in the South Indian state Kerala, where rooftops gleam with solar panels and homes have turned into micro power plants. It was a story of how ordinary citizens, through community effort and government support, took part in a just energy transition.

That local story, seemingly small, was in fact a mirror of a far bigger movement unfolding worldwide. Now, two major global reports–one from the International Energy Agency (IEA) and another from the independent think tank Ember–confirm that the world is entering a decisive new phase in its energy transformation. Together, their findings show that 2025 is shaping up to be the turning point year: the moment when renewables not only surpassed coal but began meeting all new global electricity demand. The year will likely be remembered as the moment when the global energy transition stopped being a promise and became a measurable reality — led by the two Asian giants, China and India.

The Global Picture: IEA’s Big Forecast

‘The IEA’s Renewables 2025’ report, released on October 7, paints an extraordinary picture of growth and possibility. Despite global headwinds — including high interest rates, supply chain bottlenecks, and policy shifts — renewable energy capacity is projected to more than double by 2030, adding 4,600 gigawatts (GW) of new renewable power.

To grasp that number: it’s equivalent to building the entire current electricity generation capacity of China, the European Union, and Japan combined.

At the centre of this boom is solar photovoltaic (PV) technology, which will account for around 80% of the total growth. The IEA calls solar “the backbone of the energy transition,” driven by falling costs, faster permitting processes, and widespread adoption across emerging economies. Wind, hydropower, bioenergy, and geothermal follow closely behind, expanding capacity even as global systems adapt to higher shares of variable power.

“The growth in global renewable capacity in the coming years will be dominated by solar PV – but with wind, hydropower, bioenergy and geothermal all contributing, too,” said Fatih Birol, Executive Director of the IEA. “As renewables’ role in electricity systems rises in many countries, policymakers need to play close attention to supply chain security and grid integration challenges.”

The IEA forecasts particularly rapid progress in emerging markets. India is set to become the second-largest renewables growth market in the world, after China, reaching its ambitious 2030 targets comfortably. The report highlights new policy instruments — such as auction programs and rooftop solar incentives — that are spurring confidence across Asia, the Middle East, and Africa.

In India, the expansion of corporate power purchase agreements, utility contracts, and merchant renewable plants is also driving a quiet revolution, accounting for nearly 30% of global renewable capacity expansion to 2030.

At the same time, challenges remain. The IEA points to a worrying concentration of solar PV manufacturing in China, where over 90% of supply chain capacity for key components like polysilicon and rare earth materials is expected to remain by 2030.

Grid integration is another bottleneck. As solar and wind grow, many countries are already facing curtailments — when renewable power cannot be fed into the grid due to overload or mismatch in demand. The IEA stresses the need for urgent investment in transmission infrastructure, storage technologies, and flexible generation to prevent this momentum from being wasted.

Evidence on the Ground

If the IEA’s report is a map of where we’re going, Ember’s Mid-Year Global Electricity Review 2025 shows where we are right now — and the signs are unmistakable.

Ember’s data, covering the first half of 2025, reveals that solar and wind met all of the world’s rising electricity demand — and even caused a slight decline in fossil fuel generation. It’s a first in recorded history.

“We are seeing the first signs of a crucial turning point,” said Małgorzata Wiatros-Motyka, Senior Electricity Analyst at Ember. “Solar and wind are now growing fast enough to meet the world’s growing appetite for electricity. This marks the beginning of a shift where clean power is keeping pace with demand growth.”

Global electricity demand rose by 2.6% in early 2025, adding about 369 terawatt-hours (TWh) compared with the same period last year. Solar alone met 83% of that rise, thanks to record generation growth of 306 TWh, a year-on-year increase of 31%. Wind contributed another 97 TWh, leading to a net decline in both coal and gas generation.

Coal generation fell 0.6% (-31 TWh) and gas 0.2% (-6 TWh), marking a combined fossil decline of 0.3% (-27 TWh). As a result, global power sector emissions fell by 0.2%, even as demand continued to grow.

Most significantly, for the first time ever, renewables generated more power than coal. Renewables supplied 5,072 TWh, overtaking coal’s 4,896 TWh — a symbolic but historic milestone.

“Solar and wind are no longer marginal technologies — they are driving the global power system forward,” said Sonia Dunlop, CEO of the Global Solar Council. “The fact that renewables have overtaken coal for the first time marks a historic shift.”

China and India Lead the Way

The two reports together highlight that the epicenter of the clean energy shift is now in Asia.

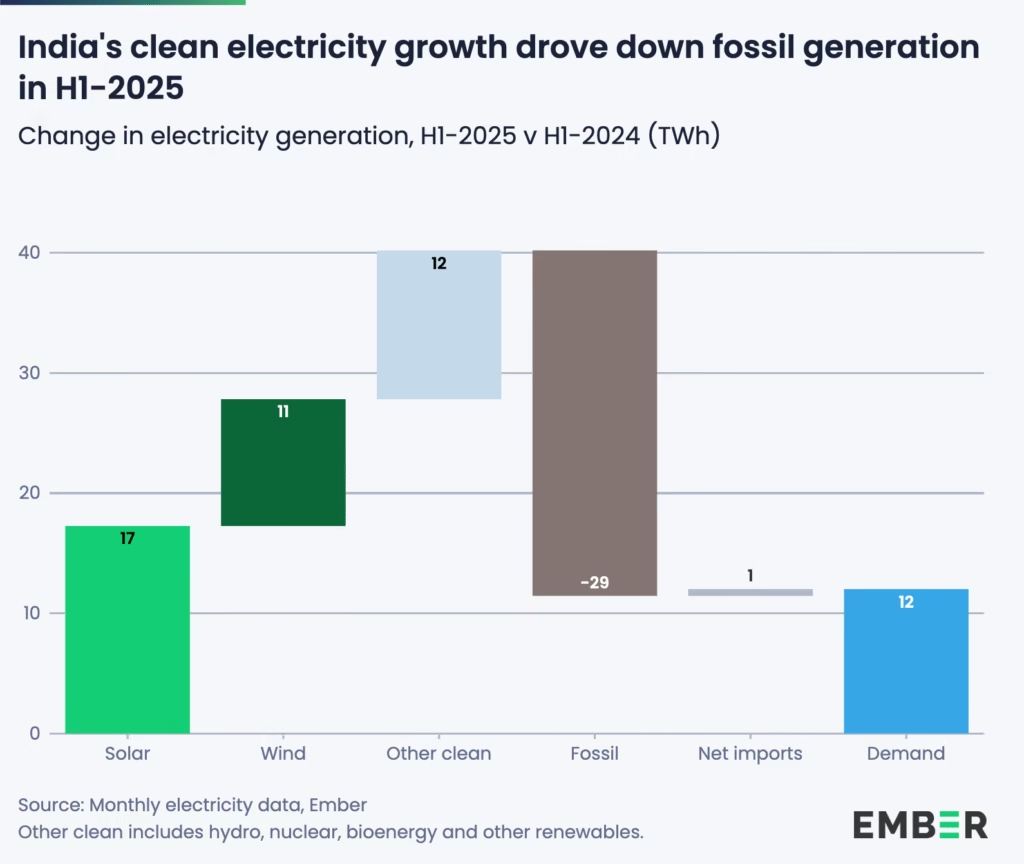

According to Ember, China’s fossil generation fell by 2% (-58.7 TWh) in the first half of 2025, as clean power growth outpaced rising electricity demand. Solar generation jumped 43% (+168 TWh), and wind grew 16% (+79 TWh), together helping cut the country’s power sector emissions by 1.7% (-47 MtCO₂).

Meanwhile, India’s fossil fuel decline was even steeper in relative terms. Solar and wind generation grew at record pace — solar by 25% (+17 TWh) and wind by 29% (+11 TWh) — while electricity demand rose only 1.3%, far slower than in 2024. The result: coal use dropped 3.1% (-22 TWh) and gas by 34% (-7 TWh), leading to an estimated 3.6% fall in power sector emissions.

For both countries, these numbers align closely with the IEA’s projections. Together, China and India are now the primary engines of renewable capacity growth, demonstrating how large emerging economies can pivot toward clean energy while maintaining development momentum.

Setbacks Elsewhere

Yet progress is uneven. In the United States and European Union, fossil generation actually rose in early 2025.

In the U.S., a 3.6% rise in demand outpaced clean power additions, leading to a 17% increase in coal generation (+51 TWh), though gas use fell slightly. The EU also saw higher gas and coal use due to weaker wind and hydro output.

The IEA attributes part of this slowdown to policy uncertainty, especially in the U.S., where an early phase-out of federal tax incentives has reduced renewable growth expectations by almost 50% compared to last year’s forecast. Europe’s problem is different — a mature but strained grid facing seasonal fluctuations and low wind output.

These regional discrepancies underscore the IEA’s core message: achieving a clean power future isn’t just about building more solar farms, but about building smarter systems — integrated, flexible, and resilient.

Beyond Power

Both reports agree that while renewables are transforming electricity, their impact on transport and heating remains limited.

In transport, the IEA projects renewables’ share to rise modestly from 4% today to 6% in 2030, mostly through electric vehicles and biofuels. In heating, renewables are set to grow from 14% to 18% of global energy use over the same period.

These slower-moving sectors will define the next frontier of decarbonization — one where electrification, hydrogen, and new thermal storage technologies must play a greater role.

The Big Picture

Put together, the IEA’s forecasts and Ember’s real-world data signal that the clean energy transition has passed the point of no return.

Solar and wind are no longer simply catching up — they are now shaping global power dynamics. Their continued expansion is not only meeting new demand but beginning to displace fossil fuels outright.

“As costs of technologies continue to fall, now is the perfect moment to embrace the economic, social and health benefits that come with increased solar, wind and batteries,” said Ember’s Wiatros-Motyka.

Yet both agencies caution: to sustain this momentum, governments must expand grid capacity, diversify supply chains, and improve energy storage systems. Without these, the 2025 breakthrough could become a bottleneck.

A Symbol and a Signal

In a way, the world in 2025 looks a lot like Perinjanam did a few years ago — a place where optimism met obstacles, but the light won. What was once a village-scale transition is now a planetary transformation, proving that even small local models can foreshadow global change.

From Kerala’s rooftops to China’s vast solar parks, from India’s wind corridors to Africa’s mini-grids, the direction is unmistakable: the sun and wind are powering the next phase of human progress.

If 2024 was the year of warnings, 2025 is the year of evidence. The global energy system is finally tilting toward sustainability — not someday, but today.

-

Space & Physics6 months ago

Space & Physics6 months agoIs Time Travel Possible? Exploring the Science Behind the Concept

-

Know The Scientist6 months ago

Know The Scientist6 months agoNarlikar – the rare Indian scientist who penned short stories

-

Know The Scientist5 months ago

Know The Scientist5 months agoRemembering S.N. Bose, the underrated maestro in quantum physics

-

Space & Physics3 months ago

Space & Physics3 months agoJoint NASA-ISRO radar satellite is the most powerful built to date

-

Society5 months ago

Society5 months agoAxiom-4 will see an Indian astronaut depart for outer space after 41 years

-

Society5 months ago

Society5 months agoShukla is now India’s first astronaut in decades to visit outer space

-

Society5 months ago

Society5 months agoWhy the Arts Matter As Much As Science or Math

-

Earth5 months ago

Earth5 months agoWorld Environment Day 2025: “Beating plastic pollution”